Health Savings Accounts (HSAs) are a favorite of ours because you get an above-the-line tax deduction for contributing regardless of whether or not you itemize on your tax return. Furthermore, the assets are able to grow tax-free so long as they are ultimately used for qualified health expenses. It is like getting the best of both worlds between traditional and Roth IRA contributions.

Health Savings Accounts (HSAs) are a favorite of ours because you get an above-the-line tax deduction for contributing regardless of whether or not you itemize on your tax return. Furthermore, the assets are able to grow tax-free so long as they are ultimately used for qualified health expenses. It is like getting the best of both worlds between traditional and Roth IRA contributions.

It can be difficult to find a custodian where you can open an HSA. We recommend either Fidelity or HSA Bank.

If you haven’t yet opened your Health Savings Account (HSA), we recommend starting the process now. Don’t wait until the last minute or you may not be able to make a contribution for the current tax year by the April 15th deadline.

Once your account is created, you can make a contribution to the account. There are two ways to make a contribution. You can contribute by depositing a check or you can link an external checking account.

Deposit a Check

To contribute to your Fidelity HSA by check, make your check payable to “Fidelity Management Trust Company FBO” and then your name. Also, write in the memo field your Fidelity HSA account number and the relevant tax year of your contribution.

To deposit the check, you can either mail the check or use mobile deposit.

If mailing, the current address is Fidelity Investments, P.O. Box 770001, Cincinnati, OH 45277-0047.

For mobile deposit, you can use the Fidelity app to deposit the check. Once you are logged into the Fidelity app, click “Transact” in the center of the bottom row of icons.

The page that loads will look like the below image. On that screen, click “Deposit Checks”.

You will first be asked to select which account you would like to deposit your check into. Select your HSA.

Next, you will be asked to identify the contribution year. HSAs allow prior-year contributions, which means that contributions for last year’s tax year can be made up until the tax filing deadline which is usually April 15 of the following year. After April 15, you will only be eligible to make contributions for the current year.

Lastly, you will be asked to enter the amount you are depositing.

Once you’ve provided those details, you will be asked to take front and back images of your check. Be sure to give the Fidelity app permission to use your camera.

First, you will take a picture of the front of your check. Once that is complete, you will be prompted to take a photo of the back of your check. Fidelity will remind you to endorse the back of the check with your signature and by writing “For deposit only to Fidelity”.

After the two images are captured, they will be uploaded to Fidelity and you will be given another opportunity to preview your deposit. If everything looks correct, you can click “Submit Deposit” to finalize the process.

Lastly, you will see a confirmation page which says “Your checks have been submitted for deposit” as well as a confirmation number and a summary of the deposit information. At the bottom of that screen you are given the option to deposit another check or to be done.

Deposits are generally posted to your account by the next business day.

External Checking Account

To make a contribution to your Fidelity HSA electronically, you can establish a link to your external checking account using their online banking system.

On the main page after you login, click “Transfer” in the top left menu (under Accounts & Trade).

On the page that loads, you will be prompted to select the account from which you would like to move money.

In the drop down menu where it says “select one”, select the option “Link a bank to a Fidelity account.”

At this point, you will be prompted to verify your identity using two-factor authentication with a text message.

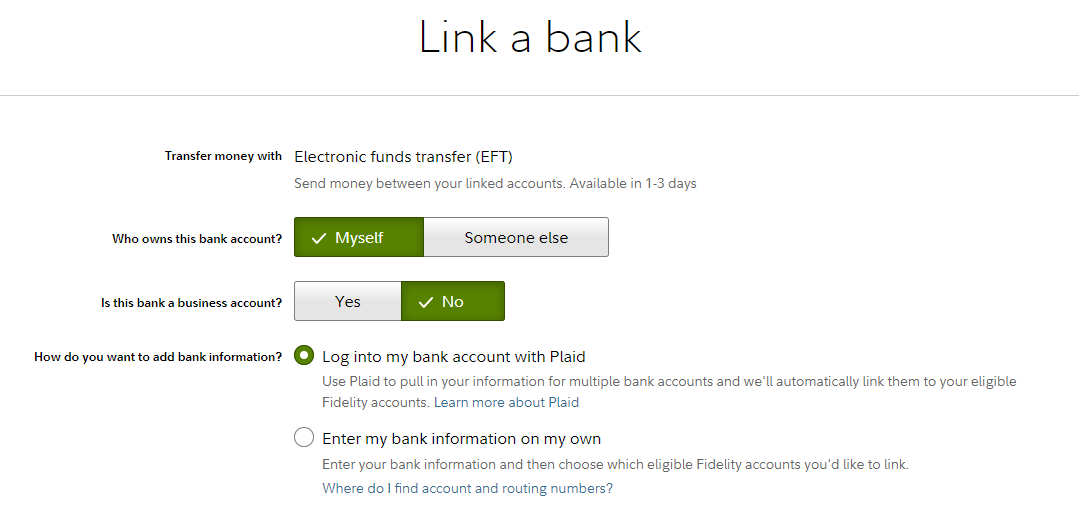

After submitting the code you receive in a text message, you can add your bank information either by logging into the account through Plaid (Fidelity’s third-party Bank connection tool) or by entering the bank information on your own.

In an abundance of caution, I recommend selecting entering your bank information on your own. After that selection, you will be asked to enter information about the account. The information you need is:

- Do you own the bank account or does someone else?

- Is it a checking/brokerage or savings account?

- What is the the routing number and account number?

You will lastly need to agree to Fidelity’s terms and conditions:

Once you click “Agree & Continue” you will be ready to make contributions.

Once again, click on “Transfer” in the top left menu (under Accounts & Trade).

On the page that loads, you will be prompted to select the account from which you would like to move money. This time, you can select the external account you linked in the previous steps.

Next, you will be asked where the money will be transferred to. Here, you can select your Health Savings Account.

Lastly, you will be asked which tax year you are contributing to. You should select the relevant year. HSAs allow prior-year contributions, which means that contributions for last year’s tax year can be made up until the tax filing deadline which is usually April 15 of the following year. After April 15, you will only be eligible to make contributions for the current year.

After this selection, you will be able to enter your transfer details.

For frequency, select “Just Once.” For date, you can use the default which will be the next available business day. For amount, enter the amount of your contribution. Make sure that your contribution stays under your HSA contribution limit for the relevant tax year, including possible partial year limitations.

On the next page, you will be asked to review your transfer details. If it all looks correct, the last step is to click “Submit”

We recommend that you fund your Health Savings Account (HSA) to the maximum limit each year and that you keep funding it to the maximum as long as you can no matter how much money you have in the account.

If you need help with the Fidelity website, you can contact them directly at 800-544-6666.

Photo by Toa Heftiba on Unsplash. Image has been cropped.