In addition to our “Comprehensive” and “Collaborative” service levels, we also offer some of our services in a “Do-It-Yourself” service level that has a lower annual fee and no minimum. Basic services include asset allocation design and portfolio management. Some additional bonus services are available for an additional charge. We typically recommend using Charles Schwab as the custodian for our “Do-It-Yourself” level accounts.

In addition to our “Comprehensive” and “Collaborative” service levels, we also offer some of our services in a “Do-It-Yourself” service level that has a lower annual fee and no minimum. Basic services include asset allocation design and portfolio management. Some additional bonus services are available for an additional charge. We typically recommend using Charles Schwab as the custodian for our “Do-It-Yourself” level accounts.

Charles Schwab has good customer service and a relatively easy to use online banking system. However, it can be difficult to get started because their technical documentation is both hard to find and sometimes outdated.

After you have opened your Charles Schwab account, there are many methods of contributing to or funding your account. We wrote about the best and easiest four methodologies in The Best Way to Fund a Charles Schwab Account. Unfortunately, not all of these methods are available for funding an individual 401(k) at Schwab. For example, you may not fund your Schwab individual 401(k) with a mobile check deposit or a MoneyLink transfer.

Schwab recommends using one of the following three methods to fund an individual 401(k).

Check Deposit

The first way you can fund your individual 401(k) is by mailing a check and a completed Schwab Contribution Transmittal Form to Schwab via a postage paid envelope. Luckily, the process is fairly simple.

Write a check payable to Charles Schwab & Co., Inc. Then, endorse the back with your signature and write “for deposit only in” followed by the relevant account number. We recommend also writing, “401(k) contribution for tax year [the Relevant Tax Year here]” on the memo line so Schwab reports the contribution correctly to the IRS.

Then, fill in the relevant information in the three sections on Schwab’s Contribution Transmittal Form and sign and date. Schwab notes to “Use a separate form for each plan year” in the instructions, so you will need to fill in multiple forms if you are contributing for multiple years.

For a more complete review of check deposits, read “Charles Schwab: How to Fund Your Account with a Check.”

Journal Funds from a Schwab Corporate Account

If you have a Schwab One Account for an incorporated or non-incorporated organization, you can fund your individual 401(k) by moving funds from that account to your individual 401(k).

This transaction can be done online via Schwab Alliance by following the steps in our guide, “How to Move Cash Between Your Schwab Accounts.”

You can also find a quick walk through of this process in a Schwab tutorial video under Transfers and Payments after you login to Schwab.com.

Wire Transfer

Another way you can fund your individual 401(k) is by initiating a wire transfer from an outside financial institution. You can find the necessary information to provide to the outside financial institution online via Schwab Alliance.

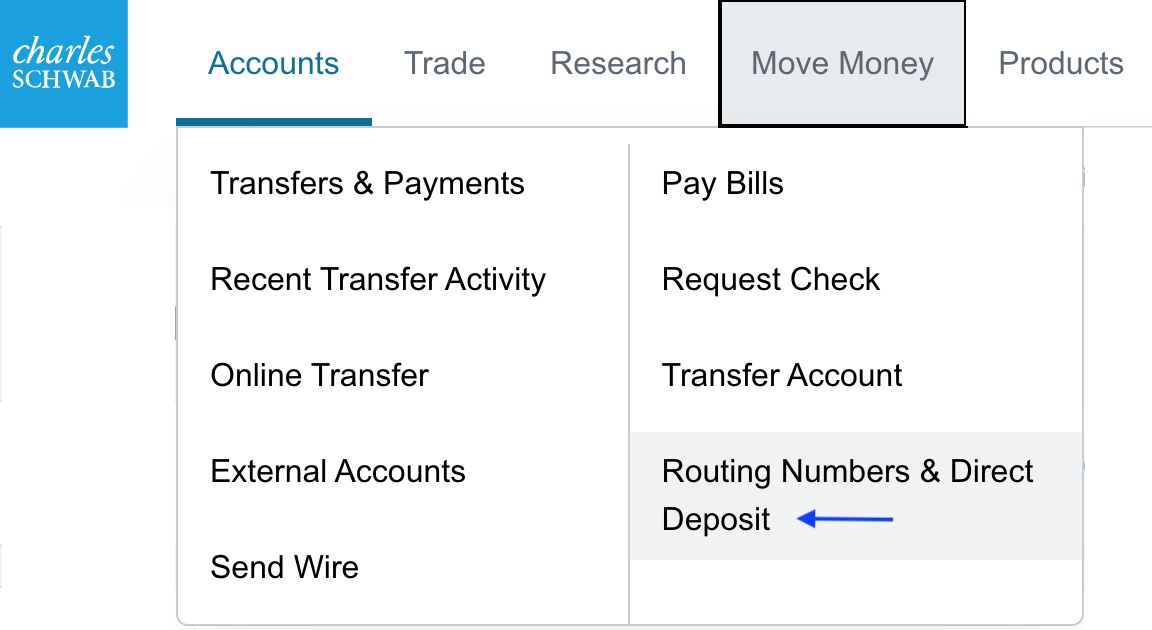

After logging in to Schwab Alliance at https://www.schwab.com, click on the “Move Money” tab at the top and select “Routing Numbers & Direct Deposit”.

Then, select your individual 401(k) by clicking the blue drop down box that says, “Select An Account.”

You will then see instructions for domestic, international, and currency-specific wires. Select “Domestic wire instructions” if the outside financial institution is within the U.S. This will show the information for you to provide to the sending institution for a wire coming into your Schwab account.

We do not recommend using wire transfers when other methods are available because they are difficult to reverse if a mistake is made and often come with a fee of $25 or more per wire transfer.

Before funding your individual 401(k) with any of the methods described above, we recommend checking the contribution limits for the tax year you are funding to ensure your contribution is under the limits. For more information regarding individual 401(k) contributions, read “Individual 401(k) Elective Deferral Limits and Deadlines.”

As always, if you have any questions or need help with the Schwab website, you can call Schwab Alliance at 800-515-2157 or message them via the message center.

Photo by TheStandingDesk on Unsplash