If you’re like me, you have limited time to devote to organizing your finances. Even if you enjoy organizing your financial life, you only have so much time and mental energy to devote to budgeting, saving, and planning for the future, not to mention paying bills and taxes.

Often the needs and wants of the present take our attention at the expense of those of the future. It makes sense to set up as much of your savings as possible to occur automatically, so you don’t have to try to remember every month. That way you can get on with your life confident in the knowledge that you have prioritized saving over spending every penny you make. You want a system that will prioritize saving without needing your constant attention.

One note about this suggestion: this “automatic plan” is for automating your saving, not your bills (there are bank bill-pay systems to organize your bills if you are interested in going that route).

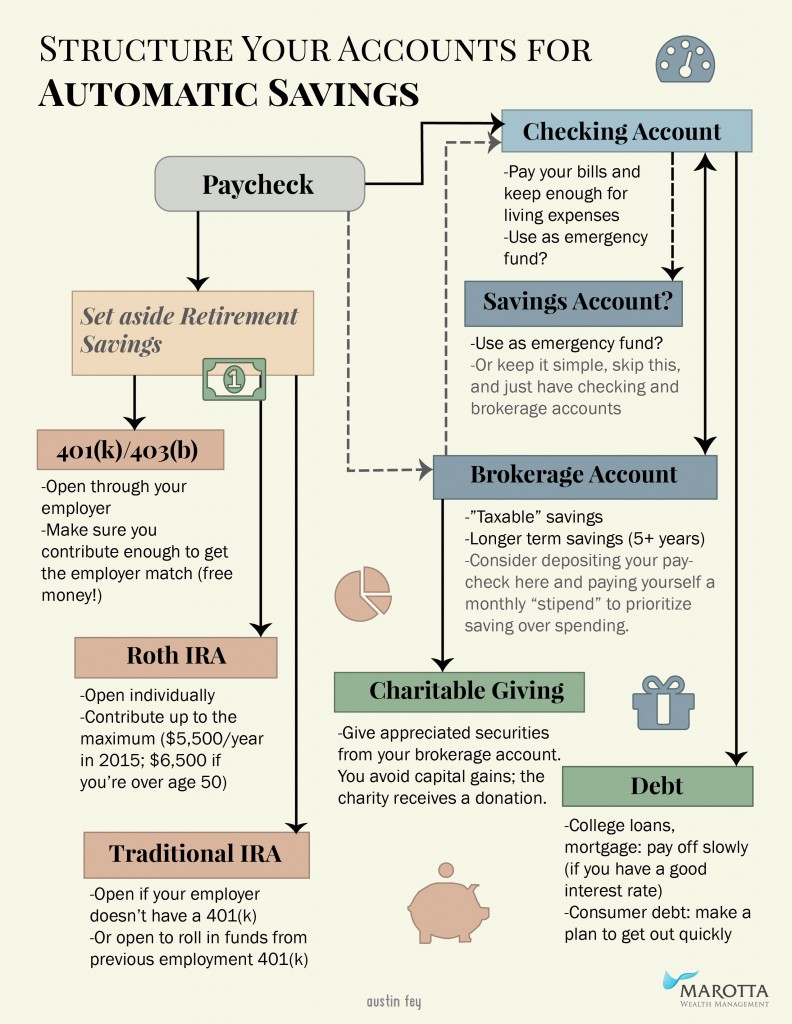

Here is a chart with suggestions of accounts to have and how to structure them so you make saving a priority. If you save first and put that money in a place that is more difficult to touch (like a brokerage or savings account), then you do not have that money readily available when you swipe your card and look at your checking account balance.

Click on the image to enlarge.

Other articles on the importance of deciding to save and invest money for your future:

Photo used under Flickr Creative Commons license.