We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Federal Program Inventories vs OMB: $622 Billion Missing

With trillions of dollars to spend, you’d think the least the government could do is maintain consistent records.

What Causes Jack Bogle to Shake His Head

When this poor planning affects the investments in our 401(k) plans and the communities that we live in, we pay more and we get less.

2015 Tax Facts

The tax tables have arrived! Here are some highlights to keep in mind for the 2015 tax year.

The Success of Freedom Investing

It is a simple thought experiment. Would you rather invest in South Korea or in North Korea?

What Is The US Dollar Index?

How is the change in the value of the dollar computed?

Fiduciary Fight Part 5: Lobbyists Won’t Help

“We’d be fools to underestimate their tenacity and creativity when it comes to protecting their executive bonus pools.”

How Much Should I Have Saved Toward College in 2015?

With three young energetic boys, the growing costs of college education weigh heavily on my mind. Here are the age-based benchmarks we use to ensure that our 529 college savings is on track to meet our goals.

What is the Federal Program Inventory?

The GPRA Modernization Act of 2010 had a vision: to “provide Congress and the public a clearer picture of the programs that exist across the Federal government.” Like most things in government, it failed to live up to its goals.

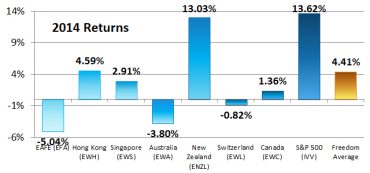

Returns from the Countries with Economic Freedom

Freedom investing beat the EAFE Foreign index by 7.92% in 2014.

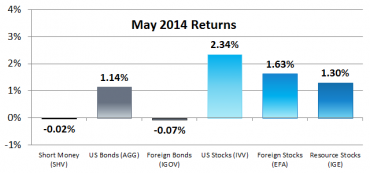

2014 Returns for Our 6 Asset Classes

When asset classes are not correlated that means they often move in different directions.

Understanding Cash Flow Is Critical

Regardless of income level, overspending causes poverty.

Does Past Performance Have Anything To Do With Future Results?

Is there a correlation which would justify talking about “the momentum of the markets”?

Fiduciary Fight Part 4: Fiduciary Oath

“Take a version of this fiduciary oath to the brokers down the street and ask them to sign it. If they refuse, ask why.”

Trying to Talk to Government? Good Luck

Despite a government “of the people, by the people, for the people”, I have found myself told time-and-again, “You’re on your own”.

One-Fund Investing

Either of these funds would be a good choice for a one-fund investment if you really want to keep it simple, and you could invest in both of them if you want a two-fund strategy.