During 2013 second quarter bond values dropped as interest rates rose sharply.

Many investors don’t understand why a bond, which pays a fixed rate of interest and then at the end of the term pays a fixed amount of principle would have its price fluctuate. Understanding bond pricing is important to understanding the role bonds ought to play in your portfolio.

Imagine a $10,000 bond with 5 years remaining in its term. Imagine it is paying 5% interest while every other 5 year bond in only paying 1% interest. Over the next 5 years it is going to pay 20% more interest than other bonds you could purchase. If you want that extra interest you will have to pay for it. You could buy a bond paying 15 for $10,000, but in order to buy a bond paying 5% you will have to pay much of the 20% extra up front. In other words, you might have to pay $11,850 for a $10,000 bond paying 5%. Even so, you will make an extra $250 over what other bonds are paying over the next 5 years.

Bonds which are paying more than the going interest rate trade higher than the face value. This is called trading at a premium. If the face value of the bond is $10,000, bonds trading at a premium would cost more than the par $10,000.

Bonds which are paying less than the going interest rate trade below the face value of the bond. This is called trading at a discount. If the face value of the bond is $10,000, bonds trading at a discount would cost less than the par value of $10,000.

What is odd about buying a bond at a premium is that the value of your bond will gradually drift from $11,850 down to the $10,000 par value. Even though you are getting paid more interest than the going rate, you will experience a capital loss every year. This capital loss is slightly more than made up by the fact you are receiving extra interest.

Now imagine interest rates on 5-year bonds are at 1% but you purchase a 5-year bond paying 5% at a premium paying $11,850. The month after you purchase your bond, interest rates on 5-year bonds rise to 2%. This causes the value of your bond to drop to $11,350. You just lost 4.2% of the price of your bond.

The rules of thumb is that bond prices will fall by the change in interest rate times the duration of a bond. A one percent rise in interest rates causes bonds with a five year duration to lose 5% of their value.

The duration of a bond is slightly shorter than the maturity. A bond maturing in 5 years is paying a portion back in interest every month. The interest payments might lower the duration to 4.2 years.

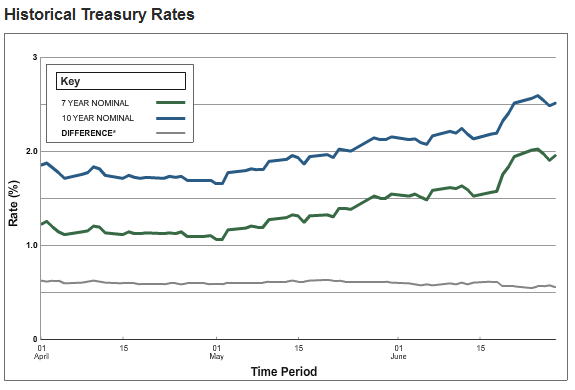

Interest rates rose sharply during the second quarter of 2013.

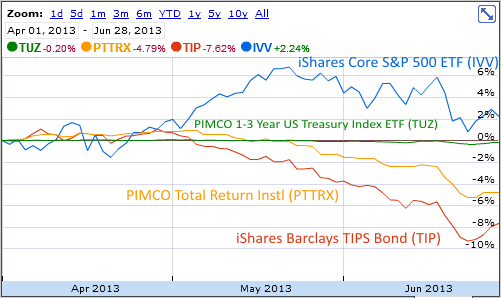

In our graph at the top of the page there are three bond funds each with a different yield and effective duration:

- PIMCO 1-3 Year US Treasury Index ETF (TUZ) has a yield of 0.31% and a average effective duration of 1.86 years. It was down 0.20%.

- PIMCO Total Return Instl (PTTRX) has a yield of 3.87% and a average effective duration of 4.73 years. It was down 4.79%.

- iShares Barclays TIPS Bond (TIP) has a yield of 1.62% and a average effective duration of 7.84 years. It was down 7.62%. TIP also gets an inflation adjustment adding to its yield.

As you can see, getting paid more yield usually means having a longer effective duration which means more risk to interest rate movements. We have a methodology which uses relatively stable fixed income investments to ensure the next 5-7 years of safe withdrawals in retirement. Risk and return should be balanced to give you the best chance of meeting your goals, and not be focused solely on getting the highest average return.

One Response

Charles

Really enjoyed going over your knowledge of the bond market. The choice of the right assets and maintaining a healthy asset allocation goes a long way in meeting ones financial goals.