The Journal of Financial Planning had a nice article entitled, “Tax Alpha: How to Fix a Client Portfolio ” by Allan S. Roth which read in part:

Good financial planners can be worth their weight in gold in helping clients build a tax-efficient portfolio.

And for the wealthiest clients, achieving tax alpha can yield a small fortune annually…

The two critical components here are selecting tax-efficient products and locating the right products in the tax wrappers that maximize after-tax return…

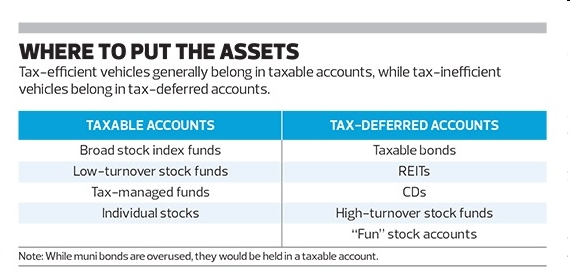

Next comes asset location. Tax- efficient vehicles belong in taxable accounts, while tax-inefficient vehicles belong in tax-deferred accounts, such as 401(k)s and IRAs. Roth wrappers are much more complex as I’ll touch on in a bit. See the “Where to Put the Assets” chart below for a general guideline for asset location.

Even CPAs tend to get asset location wrong because everyone gets taught that stocks are for the long run — and we think of our IRAs and 401(k)s as long-run wrappers. Yet placing stocks in an IRA converts what would have been a lower long-term capital gain rate into a higher ordinary income rate when it comes time for the client to take withdrawals.

This advice is very similar to our three part series on choosing the appropriate investment vehicle for where to put each asset. Tax efficient investing is even more important when you add Roth accounts into the mix. Roth accounts are the frictionless vacuum that you study in high school physics class – free of all taxation drag and able to grow unimpeded.

There were two side comments which I found worth remarking on. The first comment was the note in the chart: “While muni bonds are overused, they would be held in a taxable account.” I’m not a fan of muni bonds. And while we agree with what this article suggests, that bonds are best put in tax-deferred accounts, there is little reason to invest in muni bonds at all. Since stocks belong in taxable accounts and Roth accounts, bonds are best put into tax-deferred accounts, and therefore it is more tax efficient to put taxable bonds into tax-deferred accounts than it is to buy muni bonds in a taxable account.

The second aside worth noting was this parenthetical comment:

The broadest stock index funds, such as total U.S. or total international stock funds, have the lowest turnover and are the most tax efficient.

(Higher turnover also, by the way, tends to result in lower returns even before taking into account these taxable consequences.)

A high turnover ratio for stock funds reflects active management which often has higher expense ratios and therefore lower returns. Index funds with low expense ratios tend to do better.

Finally, Allan S. Roth is also a fan of Roth accounts and Roth conversions:

ROTH CONVERSIONS

Even if a client doesn’t need the money to live on, multiple Roth conversions can be helpful — particularly if the client has retired and deferred taking Social Security. The goal here is to pay taxes sooner at a lower rate rather than later at a higher rate, when the client is taking Social Security and has higher income.

Roth conversions are especially attractive because they qualify for the one do-over the IRS does allow: recharacterization. Since a conversion requires paying taxes now, it’s the equivalent of buying the government’s share out.

I recommend making multiple conversions into different asset classes, so that any investment that performs poorly can be recharacterized later — essentially making the government buy back its share at the original price.

We have written extensively on Roth conversions, especially in the gap years between retirement and required minimum distributions. We are also advocates of multiple Roth Segregation accounts and utilizing the ability to recharacterize a Roth conversion keeping only those accounts with the best returns.

It’s good to see another financial planner breaking down the tax-efficient investing strategies we’ve used for our own clients. Not all managers are as scrupulous.

Watch our video on Roth conversions.

Photo used here under Flickr Creative Commons.