Roth Recharaterizations are no longer part of the tax code.

For a description of how this changes this Roth conversion strategy, read “No Roth Recharacterizations After 2017?”

The IRS does not handle Roth Recharacterizations well.

By federal law, any time before you file your taxes you can move any of the Roth conversion back to the traditional IRA from which it came. This is called a Roth Recharacterization. Since your original conversion has either gained or lost money, reporting this event to the IRS is not simple. Generally it involves text which looks something like this:

(Your name) made a conversion of (Value at time of conversion) from a traditional IRA on the date(s) shown on the attached, and then recharacterized a total of (Actual recharacterized), of which the earnings portion is (Gain/Loss recharacterized to IRA). The basis of (Basis recharacterized to IRA) was recharacterized back to a traditional IRA on (Date of recharacterization) in a trustee-to-trustee transfer.

Ms. Biz made a conversion of $500,000 from a traditional IRA on the date(s) shown on the attached, and then recharacterized a total of $310,000, of which the earnings portion is $10,000. The basis of $300,000 was recharacterized back to a traditional IRA on September 15, 2010 in a trustee-to-trustee transfer.

The IRS can’t understand a Roth Recharacterization. When you do one the IRS computers are confused by the traditional IRA distribution reporting and can’t automatically reconcile the textual information accompanying your tax forms. As a result they assume you kept the entire Roth conversion but failed to pay the tax. As a result they send you a scary CP2000 form: IRS Notice of Proposed Adjustment for Underpayment/Overpayment with something like the following:

Getting a bill from the IRS for $116,428 is scary. But every notice from the IRS is scary.

They assume that you are guilty until proven innocent. Their deadlines are short. And IRS form letters are filled with threats (promises) of additional charges of interest and penalties to be added if you delay your response. Providing the appropriate documentation is one of the reasons we do not recommend doing a Roth conversion or recharacterization without the support of a CPA and financial advisor to help you through the process.

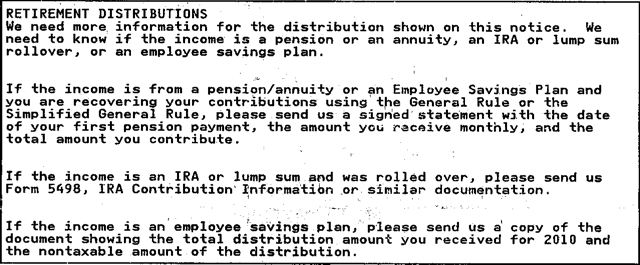

In the case of a Roth recharacterization you can expect such a letter from the IRS. Toward the end of the letter there is a section entitled 2. Reasons for the Changes. For Roth recharacterizations it will normally include the following language:

Currently the IRS is sending these notices for Roth Recharacterizations done for 2010 taxes. These are form letters that throw the burden of reviewing your tax return onto you, the taxpayer. Your CPA can help you reply.