I know that gold and silver have been touted for some time now. A large number of people in the United States are worried about our profligate spending and the resulting devaluation of our currency. They are worried about politics and socialism and the economy. And while these are all serious concerns, gold and silver investing is not the answer to how to build real wealth.

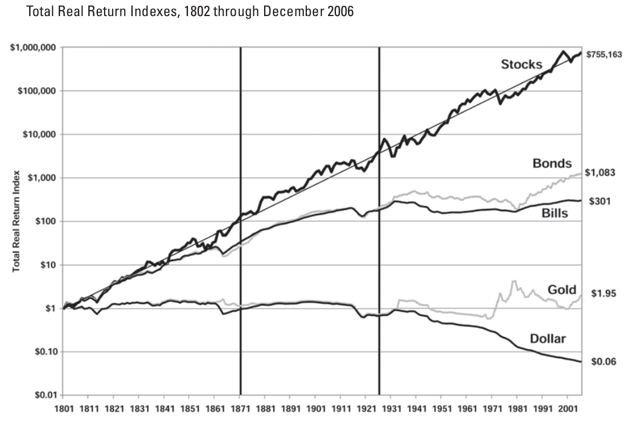

Each investment has a mean return. That return is equal to the value of the underlying asset, which usually appreciates by inflation, and the value added to that asset which produces additional income. Let’s look at a series of investments.

The U.S. Dollar has no underlying asset. Stuffed into your mattress (which is equivalent to the lack of interest in your bank account), cash depreciates by inflation every year. And we are having real inflation which is more significant than the official government numbers.

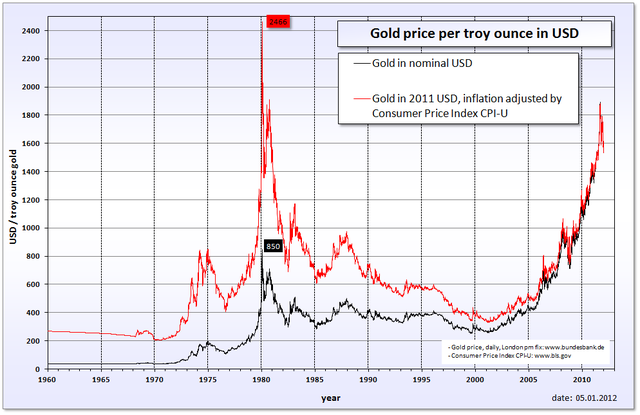

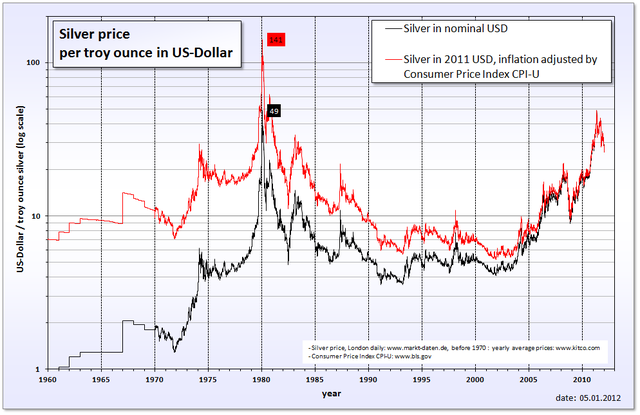

Gold and silver generally hold their value. They appreciate by inflation. There is no additional value added. Gold and silver also rise and fall with global fears. They can be very volatile, even when measured in inflation adjusted dollars.

Bonds generally earn about 3% over inflation. Bond holder require both an adjustment for expected inflation plus an additional 3% premium when lending over longer periods of time. Governments can keep these interest rates low when they are printing money by artificially flooding the supply of money. When there is no demand for money because of excess supply, the prices on everything rise. Investors would rather have real things than fiat money.

Stocks represent shares in a real company. Shares in a company appreciate in two ways. They appreciate with inflation as the company is worth more. They also appreciate as real work in the company adds value and earns a profit. Corporate earnings can be return to the shareholders as dividends or they can be reinvested in growth the company to add additional shareholder value. On average stocks return inflation plus an additional 6.5%.

Here is a chart from Jeremy Seigel’s Stocks for the Long Run:

As you can see, although gold (and silver) hold their value, they don’t add any value and therefore simply keep up with inflation.

Here is a recent chart of the value of gold (red is inflation adjusted):

And here is a recent chart of the value of silver (red is inflation adjusted):

During this same time period (1960-present) the S&P 500 has gone from 59.5 to over 1,400!

Stocks for the long run.

Subscribe and receive free presentation: If Not Gold, Then What?!

One Response

Robert froelich

One fact missing regarding gold & silver — the price is currently manipulated on the COMEX to hold the price down. That manipulation is about to end and no one knows high high the price will go. Conservative estimates are $5000 per ounce for gold and $150 an ounce for silver. Current price is below all usually used moving averages.