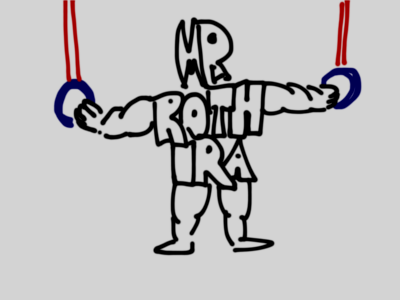

The Roth individual retirement account gives savers tax-free retirement income and even provides a good place for emergency savings. But it is even more versatile than that. Mr. Roth can also help with transferring gifts to your heirs, accessing restricted funds from other accounts and paying for a new house or college expenses. But don’t ask him to iron your clothes. That’s where he draws a line.

The Roth individual retirement account gives savers tax-free retirement income and even provides a good place for emergency savings. But it is even more versatile than that. Mr. Roth can also help with transferring gifts to your heirs, accessing restricted funds from other accounts and paying for a new house or college expenses. But don’t ask him to iron your clothes. That’s where he draws a line.

An inheritance vehicle

Mr. Roth can help your heirs for an entire lifetime. From the beneficiary’s perspective, an inheritance from Mr. Roth is better than pure gold. He also offers some distribution incentives that encourage long-term discipline with the money.

A Roth IRA inheritance can remain tax free for the entire life of the beneficiary, unlike a traditional IRA. Thus Roth IRAs are most powerful when young heirs inherit them. Grandparents can skip an entire generation of taxes by naming their grandchildren or great-grandchildren to inherit a Roth. Normally, a gift to someone 37½ years younger than you, skipping a generation, incurs a tax.

Many grandparents like the idea that a Roth IRA offers a huge disincentive to quickly fritter away an inheritance. Mr. Roth offers children and grandchildren reasonable guidelines for tax-free distributions that will last for the remainder of their lives. Beneficiaries must make distributions from an inherited Roth based on their own life expectancy.

So if the grandchild is five years old, the first year’s distribution must be at least 1.29% of the total account, and this increases gradually each year. The heir can withdraw more, but not less. The downside of accessing this money too quickly is losing the benefit of tax-free growth.

A conduit vehicle for IRA and 401(k) distributions

Mr. Roth offers added flexibility if you need to access funds from your other retirement accounts. If you distribute funds from these accounts before age 59½, you get slapped with a 10% penalty. But if you work with Mr. Roth, he may be able to help.

For example, last year I decided to pull some funds from my retirement accounts to cover some additional expenses. I didn’t want to withdraw these funds directly from Mr. Roth because I want to maximize my tax-free growth. I also didn’t want to pay the extra 10% penalty for withdrawing funds from my IRA or 401(k) account.

To compromise, I converted funds from my IRA and then took a distribution from Mr. Roth. When you convert to a Roth, you pay taxes on that money since it was initially tax-deferred. The tax on the conversion is not as bad as the penalty for withdrawing directly. Technically, the conversion funds have a five-year restriction before I could access the funds. But in my case, but I had plenty of contributions from prior years that were still accessible with no strings attached.

This option to use Mr. Roth as a conduit transfer vehicle is only possible if you have contributed prior funds. The earlier you start contributing to Mr. Roth, the more flexibility you have.

College expenses

Sound financial planning advice always recommends prioritizing retirement savings over kids’ college savings. After all, no scholarships or subsidized loans are available to retirees. However, if your retirement savings goals are over-funded, Mr. Roth can help you accomplish both. Distributions of earnings are free of a 10% penalty when used to pay for qualified educational expenses and tax free when withdrawn after age 59½.

Retirement accounts, owned by you or your child, are not counted at all in determining the Expected Family Contribution (EFC) for purposes of federal financial aid. This means that savings with Mr. Roth don’t dash your kids’ chances of getting low-cost loans, scholarships and grants.

Be careful, though, about taking money out of any retirement account to pay for college if you qualify for financial aid. Although the tax law now permits penalty-free withdrawals from a traditional or Roth IRA to pay for qualified college costs, doing so could jeopardize financial aid the following year. The entire withdrawal, principal and earnings, counts as income on the following year’s aid application.

Many parents with Roth IRAs wait until the final year of college to begin using their Roth. Or they encourage their children to rack up loans and then help to repay these loans when the parents reach age 59½ and are eligible for tax-free and penalty-free withdrawals.

College 529 plans are another good option for educational savings but only after you max out all other available retirement accounts.

Buying a home

If you haven’t owned a home in the last two years, you qualify as a first-time home buyer and can use up to $10,000 of your Roth IRA funds to help. Some work with Mr. Roth to save for a down payment with the benefit of tax-free growth and usually better returns than savings accounts. If you dip into your earnings and the account has not been opened for at least five years, you may pay some taxes but not the penalty. Again, the earlier you start contributing to Mr. Roth, the better.

Versatility is the biggest advantage to Roth IRAs. Mr. Roth’s main advantage is to protect you from future tax increases, provide tax-free retirement income but his ability to support other needs is often underappreciated.

The first part of this Mr. Roth series can be accessed here.

2 Responses

Carol Smith

I totally agree with the Power of the Roth arrangement. With Roth, you pay known taxes today for potential tax free distributions later. I do want to raise the issue that the Obama budget proposal included provision to chipping away at the popular ‘stretch’ concept, at least for taxable accounts. The proposal would limit life expectancy payouts of inherited monies to a spouse only, not children or grandchildren. I suspect that eventually the ability to enjoy decades of payments out of IRAs — and maybe Roth IRAs — may be on the tax revision ‘hit list’ for revision. Just wanted to raise the possibility to be on the lookout. So enjoy the inheritance ‘stretch’ provisions for now.

Matthew Illian

Carol, you are correct that Obama has some of the more far reaching tax deferral benefits of retirement accounts in his sights. Let me clarify what you were alluding to. On April 10, President Obama released his budget proposal for 2014 which included a proposal to further restrict the flexibility of IRA tax deferral. Not only did he propose a $3.4M funding cap but he also proposed limiting the stretch feature of the IRA to only include disabled children, beneficiaries within 10 years of age of the decedent, and minor children (who wouldn’t have to begin the 5-year distribution period until they reached the age of majority); Which means if you will your Roth IRA to a five year old, you would still get an additional 13 years of tax free growth before a young beneficiary would be required to withdraw large sums from an IRA account. Everyone else would need to distribute their IRA accounts within five years and miss out on extended tax deferral.