Inflation is defined as the rate at which the cost of goods and services is rising. Stated in the reverse, inflation is the rate at which the purchasing power of currency is falling. In this way, inflation is the risk to keeping your assets in cash.

Inflation is defined as the rate at which the cost of goods and services is rising. Stated in the reverse, inflation is the rate at which the purchasing power of currency is falling. In this way, inflation is the risk to keeping your assets in cash.

Most investors greatly underestimate the danger of inflation, but it is important to design asset allocations which are prepared to weather all kinds of inflationary cycles.

In the 2011 article, “Inflation and the US Bond and Stock Markets,” Jim O’Shaughnessy uses the Dimson-Marsh-Staunton dataset to review the real (inflation-adjusted) returns of U.S. bonds and stocks over various inflationary time periods.

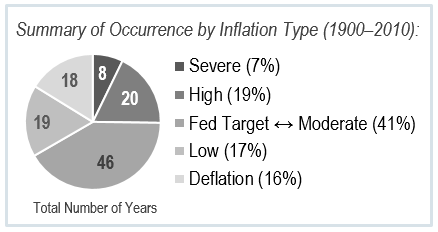

He creates the following inflation regimes and analyzes each one individually:

| Inflation Regime | Annual Inflation Rate Range | Occurrences |

|---|---|---|

| Severe | greater than 10% | “1916–1919, (all four of which suffered double-digit inflation) and the period between 1974 and 1980, which had three years of double-digit inflation (1974, 1979, and 1980).” |

| High | between 4.4% and 10% | “The predominate three periods that show high inflation are those surrounding World War II and its aftermath (1941, 1942, 1947, 1950, and 1951); the inflationary period of the late 1960s and 1970s and the aftermath of the great inflation of the 1970s (1981; 1987–1990).” |

| Moderate | between 2.0% and 4.4% | “This is the largest sample from the 111 years of the dataset, encompassing 46 years of the 111 analyzed (41.44 percent of the entire sample).” |

| Low | between 0% and 1.60% | “The main periods of low inflation occurred during the first decade of the twentieth century, during the years 1952–1955; and during the years 1959–1964. Also included are the years 2001, 2008, and 2010.” |

| Deflation | less than 0% | “Prices fell in the United States in just 18 of the 111 years we’ve looked at… . The one extended period of deflation was during the years 1930–1932.” All these years are prior to 1955. |

O’Shaughnessy describes the frequency of the occurrences using the following table:

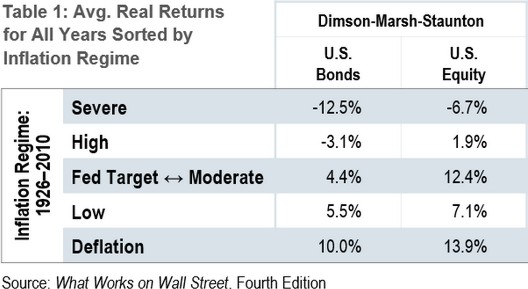

The result of his analysis was the following table:

You can see from this table several interesting details.

First, stocks have a higher real return than bonds during all inflation regimes. This may be unsurprising, as stocks are riskier so they ought to afford a higher risk premium, but it is an important finding.

Second, while both bonds and stocks suffer during years of high and severe inflation, bonds are especially hurt in periods of severe inflation. In fact, if you are expecting high inflation, it may be stocks which offer the greatest security against the diminishing dollar.

Third, in the most common inflation regime of moderate inflation, the average real return of stocks is significantly higher than bonds (12.4% for stocks compared to 4.4% for bonds). This is one reason why we say investing mostly in bonds means having a lower lifestyle in retirement.

Fourth, both bonds and stocks fair well during low inflation and deflation with the gap between them closing. When prices are predictable and the dollar is stable, all investments offer the chance for growth.

If you are worried about inflation, our article “How to Survive High Inflation” might be a good one to read next.

Photo by Zac Ong on Unsplash. Image has been cropped.