Research shows that the more readable a mutual fund’s fee disclosure packet is, the more likely it is to have lower fees. Lower fees pay off for investors.

Research shows that the more readable a mutual fund’s fee disclosure packet is, the more likely it is to have lower fees. Lower fees pay off for investors.

Last year in 2020, Kim Blanton interviewed me on mutual fund fee complexity and the research paper “Obfuscation in Mutual Funds ” for the Center for Retirement Research. She summarizes:

An analysis of S&P 500 index funds identified numerous narrative techniques in mutual fund documents that confuse investors. The researchers – from the University of Washington, MIT, and The Wharton School – evaluated each fund’s disclosures and showed that funds with more complex explanations of their investment holdings and fees also have higher fees. The researchers call this “strategic obfuscation.”

For example, they quote Schwab’s objective (with an expense ratio of 0.02%) as:

The fund’s goal is to track the total return of the S&P 500 Index.

Compare that with Deutsche’s objective (with a much higher expense ratio), which states:

The fund seeks to provide investment results that, before expenses, correspond to the total return of common stocks publicly traded in the United States, as represented by the Standard & Poor’s 500 Composite Stock Price Index (S&P 500 Index). The fund invests for capital appreciation, not income; any dividend and interest income is incidental to the pursuit of its objective.

Across the whole prospectus, Schwab averages 24 words per sentence and totals 120,700 words, while Deutsche averages 32 words per sentence and totals 177,271 words.

The research paper has many measures of different levels of complexity.

Toward the end of the research paper, they summarize:

Consistent with theory in Carlin (2009), we find that funds with higher fees have greater narrative complexity (i.e., less readable disclosures) and structural complexity (i.e., more complicated fee structures), both of which increase investors’ processing costs. These findings are consistent with funds attempting to use complexity to obfuscate high fees and extract rents from retail investors. That we find obfuscation and excessive fees among homogeneous S&P 500 index funds is especially striking because their disclosures are heavily regulated, and because conventional wisdom is that index funds are a cheap way to obtain a diverse portfolio.

Other research has shown that disclosures do not help users understand or evaluate their choices. In fact, disclosures often confuse investors and cause them to do the exact opposite of what you might think.

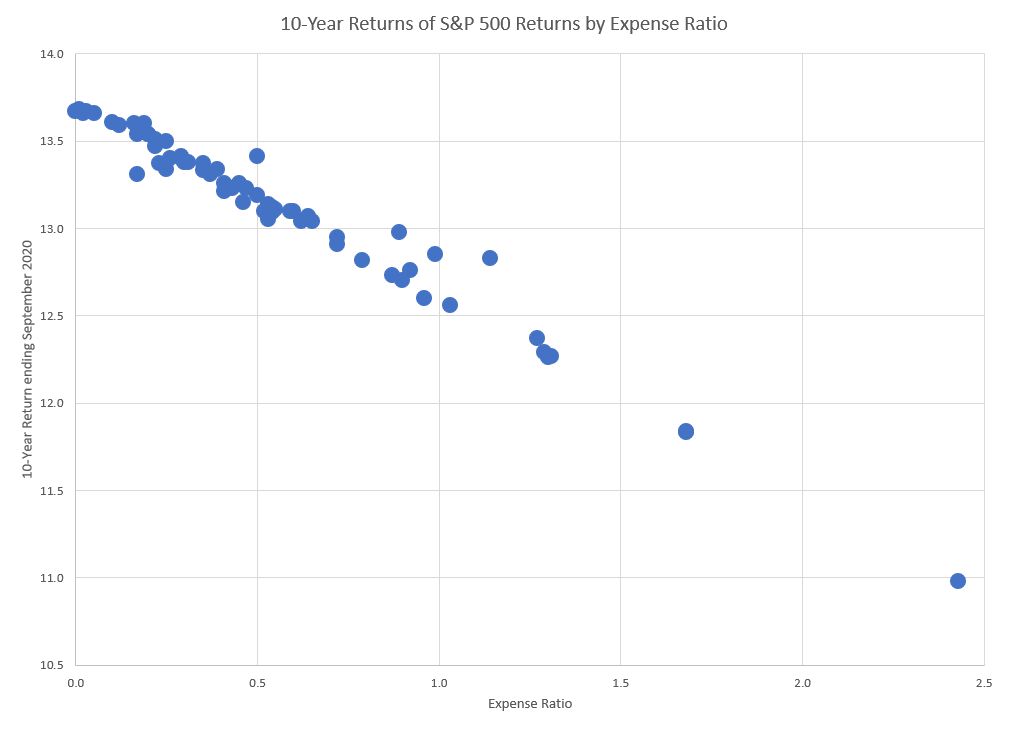

It’s important to know that the lower the expense ratio the more performance stays with the investor.

The chart below graphs all of the S&P 500 funds in the Morningstar environment on their 10-Year return by expense ratio. This chart shows that mutual fund return is equal to index return minus expense ratio plus or minus index drift. Or, in even more plain terms, if the expense ratio is higher the return is typically lower.

The returns show a clear example of how investing in index returns works. The difference in returns is nearly all based on expense ratio. The small differences from the trend line is index drift.

We think keeping expenses low is an important part of the investing process.

Photo by Sandie Clarke on Unsplash