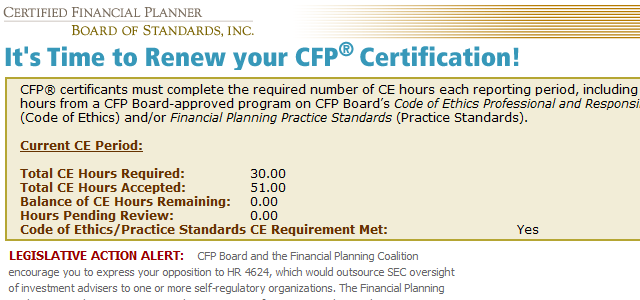

I just renewed my CFP® designation. NAPFA requires both that Advisors are compensated exclusively by a fee from the client (hence fee-only) and also that Advisors are competent (hence the requirement that they have a CFP® designation.

I just renewed my CFP® designation. NAPFA requires both that Advisors are compensated exclusively by a fee from the client (hence fee-only) and also that Advisors are competent (hence the requirement that they have a CFP® designation.

Here is the mission of the CFP Board:

CFP Board Mission:

The mission of Certified Financial Planner Board of Standards, Inc. is to benefit the public by granting the CFP® certification and upholding it as the recognized standard of excellence for competent and ethical personal financial planning.

One of the CFP Board’s latest legislative actions is as follows

LEGISLATIVE ACTION ALERT: CFP Board and the Financial Planning Coalition encourage you to express your opposition to HR 4624, which would outsource SEC oversight of investment advisers to one or more self-regulatory organizations. The Financial Planning Coalition strongly supports increased examinations of investment advisers; however, creating a costly new layer of regulation – one that will particularly harm smaller advisory firms – is not the right answer.

I written before about how you can’t regulate crooks. Unfortunately, our society tends to pass feel-good legislation aimed at making people feel safer without actually making them safer. This is just another feel-good piece of legislation. It is just an extension to the SEC Requiring a New ADV Part 2 Disclosure Form.

Unfortunately, our society tends to pass feel-good legislation aimed at making people feel safer without actually making them safer. First they make it illegal to run a Ponzi scheme. Then they require firms to disclose if they are running a Ponzi in their annual filing. Then they make it illegal to lie on their annual disclosure. Next they require a designated chief compliance officer in the firm who will check that the firm’s paperwork is in order. And finally they make it an offense for the chief compliance officer to fail to review the firm’s compliance annually.

None of this impedes the few real crooks who are willing to boldly certify their own lies.

This particular bill, however, is more insidious. Rather than just a waste of money, it could do real harm. If passed, FINRA will be put in charge of Registered Investment Advisors. FINRA is over broker-dealers, who are not held to a fiduciary standard they are only held to a suitability standard. There is a big difference between a rules based suitability standard and a principles based suitability standard.

It would result, in effect of putting the foxes in charge of the watchdogs who are supposed to protect the hen house. The rules which would begin to be applied to the watchdogs would not be for the sake of protecting the roost no matter how much the foxes might suggest they are. And the foxes out number the watchdogs about ten to one.

The official CFP opposition is much milder than it ought to be. They try to argue it on costs and government waste. So they suggest that additional SEC funding is a better idea.

Oppose FINRA as Regulator of Investment Advisers

We urge you to oppose HR 4624 (the Investment Adviser Oversight Act), a bill introduced by Rep. Spencer Bachus (R-AL) and Rep. Carolyn McCarthy (D-NY). This bill may be on a fast track with a possible hearing and vote in the House Committee on Financial Services in June. So please take action now.

HR 4624 would outsource oversight of investment advisers (IAs) to a self-regulatory organization (SRO), which will likely result in the establishment of an IA SRO by FINRA. The bill would create a new layer of bureaucracy, where one already exists, resulting in more rules and regulations, and less transparency and accountability. Click for more information.

A FINRA SRO would be twice as expensive as increasing the SEC’s examination capacity, and would extend the broker-dealer, rules-based oversight to investment advisers. According to an independent analysis conducted by the Boston Consulting Group (BCG), a FINRA IA SRO is estimated to cost $550 to $610 million annually. In contrast, to increase SEC examinations to once every four years, you only need to add $100 to $110 million to their current examination budget. For more information, read the Economic Analysis of Options and Survey of Investment Adviser Preferences.

Providing the SEC with the resources to increase examinations is the best way to protect consumers. It is more efficient, effective and does not outsource SEC oversight to an SRO that lacks accountability, transparency and experience overseeing investment advisers.

Tell Congress that you oppose HR 4624 and support funding the SEC to increase adviser examinations.

Congress at work. Check your wallet. Especially when it purports to be bi-partisan and is supposedly for consumer protection.