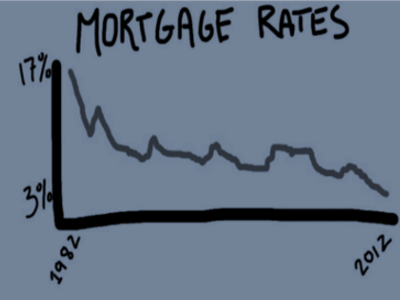

Here we go again. It’s been just over a year since I last refinanced, and I’m about to start the process all over. Yawn. Who ever thought saving money could become so humdrum? I will avoid making any “once in a generation” comments here because I was convinced last year that I would never see rates so low in my lifetime.

Here we go again. It’s been just over a year since I last refinanced, and I’m about to start the process all over. Yawn. Who ever thought saving money could become so humdrum? I will avoid making any “once in a generation” comments here because I was convinced last year that I would never see rates so low in my lifetime.

Locking into rates below 4% offers significant savings for many. In fact, I’ll save more than $20,000 over the life of my loan. However, deciding when it is cost effective to refinance can involve many complex variables. Out-of-pocket closing costs are a big deterrent to would-be refinancers. Is it better to stay with the higher rate or get the lower rate and pay the closing costs?

Refinancing costs include mortgage application fees, origination fees, attorney fees, title search, insurance, and on and on. In bankrate.com’s 2011 Closing Costs Survey, $4,070, or 2%, was the average amount charged for a $200,000 loan. New York had the highest average fees and Arkansas, the lowest.

With a traditional loan, these closing costs can either be paid at the time of closing or rolled into a larger loan. Paying the fees out-of-pocket requires you to write a big check at the closing. When the closing costs get “rolled,” a $200,000 loan becomes a $204,070 loan assuming average fees. In either case, it takes time before your reduced payments will outstrip the expenses involved in closing.

Calculating the breakeven point of refinancing is extremely complicated because the interest is amortized over the life of a loan, which means you pay down the principal very slowly in the early years. Using the preceding example, you need to wait 12 years to recoup closing costs when your rate drops by 0.5%.

Many homeowners do not feel settled enough to bank on 10 to 12 years in their current home. And who wants to penalize themselves from refinancing again if this mortgage rate madness continues even lower?

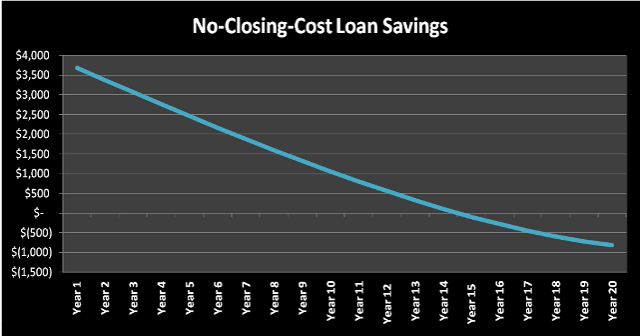

There is a better way to refinance for those with an uncertain future. Using a no-closing-cost loan, a lower rate means you start saving immediately. No need to wait years to recoup closing cost expenses. When you avoid out-of-pocket expenses and increases to your loan balance, a lower rate means less interest payments over the life of your loan.

Mortgage officers are able to offer a no-closing-cost loan by selling you a higher rate mortgage. In my case, I am being offered a rate that is 0.38% higher than the market rate in order to avoid paying closing costs. If we keep the loan for all 30 years, we’ll pay an extra $9,000 in total payments when compared to a lower rate loan with added closing costs. However, it will take 15 years before we hit the break-even point, and I’m not willing to play those odds. There are simply too many scenarios where I may choose to sell or refinance our current mortgage.

For those familiar with mortgages, you will notice that these break-even calculations are similar to the points or no-points decision. Those who plan to keep their mortgages for more than 15 years or more should take every opportunity to buy down their rates. However, most borrowers are better off avoiding the higher upfront fees.