In Roth IRA Conversion 2012: A Roth Conversion Calculator I showed how nearly everyone is an excellent candidate for executing a Roth conversion this year. But the exact amount depends on your annual taxable income, age, value of your IRA and how much it appreciates after conversion but before you have to make a decision on how much to keep as a Roth conversion. Because you can always undo part or all of a conversion with a Roth recharacterization, you can’t convert too much.

Here is the calculations for my example of Mr. Esq:

Mr. Esq is a 55-year-old lawyer earning $250,000 a year with a $2 million IRA. Mr. Esq would pay a marginal tax rate of 33% on any amount he converted between his current salary and $388,350 where the top 35% tax bracket starts. He is planning on retiring at age 65. Between 65 and 70 he will probably have no income. By age 70 his $2 million IRA will have grown slightly faster than the tax brackets will have inflated. His required minimum distributions will be approximately $100,000 at today’s scale, putting him in what will be the 28% tax bracket after the Bush tax cuts expire.

Mr. Esq will have five years between age 65 and 70 when he might be able to convert $70,700 each year in what will be the 25% tax bracket. Then at age 70 he will be in the 28% tax bracket at most. Any amount converted at a 33% marginal tax rate this year that could be converted later at a 28% tax rate would have to appreciate more than 17.9% to make the conversion worthwhile.

Mr. Esq is one of the rare cases for whom a Roth conversion in 2012 is probably not going to be advantageous. Nevertheless, there is a small chance he could convert $100,000 now and by next year the account could have appreciated over 17.9% to $117,900 or more. In that case, paying 33% of the original conversion ($33,000) is the same as paying 28% of the appreciated amount.

Even when clearly you will be in a lower tax bracket in the future, there is an amount that the Roth conversion could appreciate to make it worthwhile to keep the entire conversion!

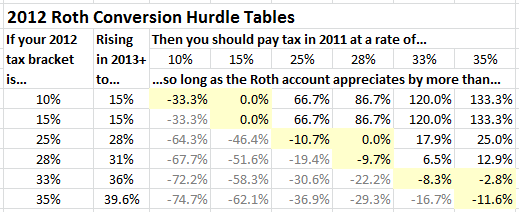

Since Mr. Esq. will probably be able to convert in the future at the 28% tax bracket, his conversion calculations should use line of the 25% rising to 28% of this 2012 Roth Conversion Hurdle Tables:

But since the first dollar converted in 2012 will be taxed at the 33% rate, the hurdle for that first dollar is at least 17.9% appreciation by the time you need to decide if you want to keep it or unconvert (recharacterize) it.

For you math geeks, the formula for the hurdle calculation is:

HurdlePct = (Marginal2011RateYouAreBeingPushedInto / BaseRateYouAreRisingIntoFor2013+) – 1;

for example, your base salary is $25,000. You are in the 2012 33% bracket but will be in a lower 28% bracket in the future. You are considering converting some money at the 33% rate. therefore:

HurdlePct = (0.33 / 0.28) – 1 = 0.179 = +17.9%

Each Roth conversion account can be converted and recharacterized separately so long as the accounts are segregated and kept in separate accounts. Keeping separate piles of money in separate accounts when doing a Roth conversion is called a Roth Segregation. Segregating accounts allow any converted account which drops by more than 11.6% to be recharacterized and not spoil the conversion of the other accounts.

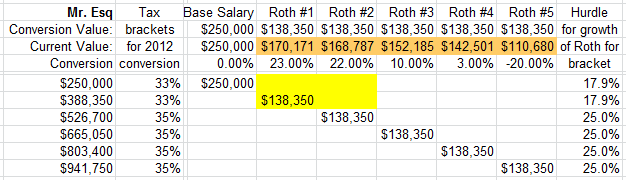

Mr. Esq’s base salary is $250,000. The top of the 2012 33% tax bracket is $388,350. Therefore Mr. Esq could keep the next $138,350 of a conversion, but only if it appreciates more than 17.9%. Knowing this, it makes sense to convert Roth segregation accounts of $138,350 each.

Imagine that Mr. Esq converts part of his $2M traditional IRA by creating five different Roth Segregation accounts of $138,350 of initial conversion amount each. Then he might invest each account differently while maintaining a balanced portfolio in aggregate. He might invest one in emerging markets, one in countries with the most economic freedom, a third in US technology, a fourth in US small cap and a fifth in bonds. These different accounts gives a greater chance that one account might appreciate more than 17.9% between the conversion in January of 2012 and the last chance to recharacterize the Roth conversion before you have to file your taxes by the extension deadline in October of 2013.

Here is a table of what amount of the Roth conversion should be kept (in yellow) based on current account values (in tan):

In this example, since Roth #1 appreciated over 17.9% it is better to keep it as a Roth an not unconvert (recharacterize) it and convert it again in future years even though it could be at a lower rate of 28%.

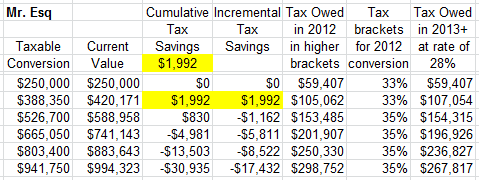

Given the account values being such that only one of the accounts should be kept as Roth conversions, The tax savings in this case is only $1,992:

In this table, Mr. Esq should keep $132,350 of the Roth conversion, which has now grown to $170,171. Adding the $132,350 onto his $250,000 base income, Mr. Esq will pay $105,062 in federal tax in 2012. This is $45,655 in additional taxes over his base salary. Having non-retirement assets to pay the tax is an important qualification to executing a Roth conversion. This is one of the reasons why we recommend every family save 10% of their pay in retirement vehicles, and an additional 5% in a taxable investment account.

Who would have thought that someone in the 33% tax bracket now who will be in a lower 28% tax bracket in the future might want to do a Roth conversion at his higher rates now?

But a Roth account could appreciate enough to make a conversion worthwhile. And any conversion can always be unconverted.

This example is for illustrative purposes only and we do not recommend executing a Roth conversion without the assistance of a fee-only fiduciary financial planner such as a NAPFA member and a professional tax advisor such as an enrolled agent or CPA.

Subscribe to Marotta On Money and receive free access to a hour long Roth IRA Conversion 2012 Seminar: How to put your money where it will never be taxed again.

2 Responses

David Alderson

To make the simplifying assumption that Mr. Esq has no dividend income or capital gains, but has a $2MM IRA and enough cash outside it to pay tax on the conversion to a Roth seems to be a stretch to me. As complicated as this already is, I think there is also the impact of the Obamacare 3.8% investment tax to consider.

David John Marotta

Greetings David,

Any qualified dividend or capital gains income will be taxed at 15% during 2012 and normally would not change the equation at all. There is a small chance that AMT will be effected by the conversion, but that is another calculation (which you can do after the conversion when you are deciding to recharacterize or not).

By paying the tax from a large taxable investment account you should reduce your taxable qualified dividends and capital gains for 2013. This should help avoid the coming 20% capital gains tax and the taxation of dividends as ordinary income. This should also avoid some of the Obamacare 3.8% investment tax as well.

So these factors should only make it more advantageous to convert. As a result, why is the assumption that even without considering them you should convert a “stretch.” I wouldn’t use the term “stretch.” I would say that if even without considering them you should convert then you should convert even under conservative assumptions.