In Roth IRA Conversion 2012: A Roth Conversion Calculator I showed how nearly everyone is an excellent candidate for executing a Roth conversion this year. But the exact amount depends on your annual taxable income, age, value of your IRA and how much it appreciates after conversion but before you have to make a decision on how much to keep as a Roth conversion. Because you can always undo part or all of a conversion with a Roth recharacterization, you can’t convert too much.

Here is the calculations for my example of Mr. Average:

Mr. Average, age 45 and earning $75,000 with a $500,000 IRA rollover from a previous employer. He is in the bottom of the 25% tax bracket and not liable to be earning less either now or in the future. His 25% bracket is rising to 28% at the end of this year.

The hurdle for keeping the next $67,700 is -10.7% because of the incredible opportunity of paying a lower rate this year.

That means that if he converts an extra $10,000 in the 2012 25% tax bracket he will pay $2,500 in taxes come April 2012. Even if the Roth has dropped 10.7% in value by then he might as well keep the Roth rather than recharacterize it and move it back to a traditional IRA.Paying $2,500 on an account which has dropped to $8,930 (-10.7%) is the same as recharacterizing it, waiting 30 days and then reconverting $8,930 at the higher 28% tax bracket and paying $2,500 in taxes anyway.

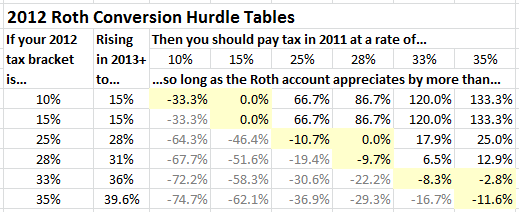

Since Mr. Average’s base salary of $75,000 will put him in the 28% tax bracket going forward in 2013 and beyond after the Bush tax cuts expire, we set the hurdle rates based on the assumption that in future years he could continue to convert any amounts recharacterized at this future 28% rate. Mr. Average is on the 25% rising to 28% line of this 2012 Roth Conversion Hurdle Tables:

For you math geeks, the formula for the hurdle calculation is:

HurdlePct = (Marginal2011RateYouAreBeingPushedInto / BaseRateYouAreRisingIntoFor2013+) – 1;

for example, your base salary is $75,000. You are in the 2012 25% bracket and will be rising to the 28% 2013+ bracket. You are considering converting to the top of the 25% tax bracket. therefore:

HurdlePct = (0.25 / 0.28) – 1 = -0.107 = -10.7%

After converting up to the top of the 25% bracket, Mr. Average can convert an an additional $74,750 at 28% this year. Because he will be in the 28% tax bracket next year anyway, this conversion has a hurdle of 0%. If this conversion earns any appreciation, Mr. Average is better off keeping it and paying the tax this year. Thus with any positive appreciation, he will be glad to have converted at least $142,450.

Beyond that amount Mr. Average will pay 33% on the next $170,900. To keep a conversion at the 33% rate that could be converted in future years at the 28% rate, the account would have to appreciate 17.9%. Again, this is possible but not as likely.

Each Roth conversion account can be converted and recharacterized separately so long as the accounts are segregated and kept in separate accounts. Keeping separate piles of money in separate accounts when doing a Roth conversion is called a Roth Segregation. Segregating accounts maximized the likelihood that some of the accounts might pass this higher threshold.

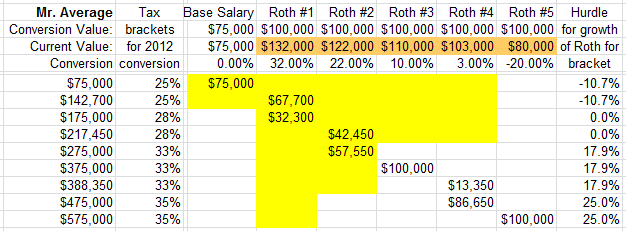

Imagine that Mr. Average converts his $500,000 traditional IRA by creating five different Roth Segregation accounts of $100,000 of initial conversion amount each. Then he might invest each account differently while maintaining a balanced portfolio in aggregate. He might invest one in emerging markets, one in countries with the most economic freedom, a third in US technology, a fourth in US small cap and a fifth in bonds. These different accounts gives a greater chance that two or three of them might pass the 17.9% hurdle over the 18 months between the conversion in January of 2012 and the last chance to recharacterize the Roth conversion before you have to file your taxes by the extension deadline in October of 2013.

Here is a table of what amount of the Roth conversion should be kept (in yellow) based on current account values (in tan):

Since Roth#2 is up 22%, it should be kept as a Roth conversion in its entirety, even the amount which pushes Mr. Average into the 33% tax bracket. It has passed the 17.9% hurdle. But since the third best account (Roth #3) is only up 10%, it is not up enough. It would be better to unconvert and recharacterize to a traditional IRA and pay only 28% in 2013 or beyond. Had that third account been up 18% or more it would qualify for being kept as a Roth.

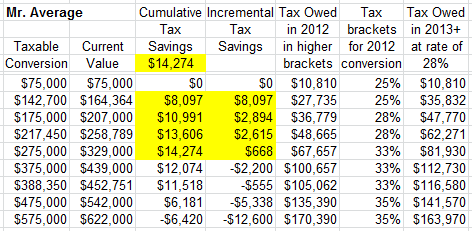

Given the account values being such that exactly two of the accounts should be kept as Roth conversions, the tax savings in this case are $14,274:

In this table, Mr. Average should keep $200,000 of the Roth conversion, which has now grown to $254,000. Adding the $200,000 onto his $75,000 base income, Mr. Average will pay $67,657 in federal tax in 2012. This is $56,847 in additional taxes over his base salary. Having non-retirement assets to pay the tax is an important qualification to executing a Roth conversion. This is one of the reasons why we recommend every family save 10% of their pay in retirement vehicles, and an additional 5% in a taxable investment account.

If Mr. Average unconverted (recharacterized) the accounts and then was able to convert the recharacterized $254,000 at 2013+ rates of 28%, he would pay $71,120 in additional taxes over his base pay or $14,274 more than he has to pay by keeping the conversion for 2012. Who would have thought that someone earning $75,000 might want to purposefully push their taxable income up to $275,000 this year in order to pay as much as possible at these lower 2012 tax rates?

This example is for illustrative purposes only and we do not recommend executing a Roth conversion without the assistance of a fee-only fiduciary financial planner such as a NAPFA member and a professional tax advisor such as an enrolled agent or CPA.

Subscribe to Marotta On Money and receive free access to a hour long Roth IRA Conversion 2012 Seminar: How to put your money where it will never be taxed again.