Comprehensive Wealth Managers often have a hard time describing the process they use to bring value to a prospective client. Because the vast majority of financial services professionals are commission based agents and brokers who make a living by selling financial products, the average consumer does not understand the difference.

One financial planning firm has an 82 page questionnaire for new clients. This is certainly better than selling products, but is often overwhelming for new clients. Better is to have 41 questionnaires, each only 2 pages long. Then for each component of comprehensive wealth management you collect the information as it arises.

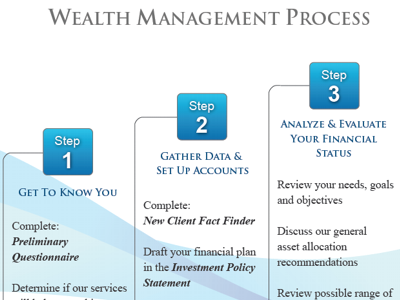

Collecting information is the hard part. A good advisor needs to be proactive on suggesting what components of wealth management are worth the time and effort to implement. And to be proactive, an advisor has to get to know their client’s financial situation and goals as well as possible. Hence the more clients tell us about their lives, the better we can help them achieve their goals.

We have used two different analogies to help clients understand that process.

The first is that we do whatever you would do if you had our time and expertise. The question we sometimes ask a prospective client is, “If you had the services of a financial advisor working for you, what would you want them to work on?”

This is a very open ended question, and can be followed up multiple times with, “What else would you have them work on?” as you take a long list of several issues and concerns.

The second analogy we use is that we are like a family practice doctor who needs to know a little bit about everything and then coordinate their care with specialists as needed. We are not estate planning attorneys, neither are we Certified Public Accountants (CPAs). But we need to know enough to recommend the services of these specialists when appropriate.

Dan Allison had an article in Practice Management Solutions Magazine entitled, “A Client Process Everyone Can Understand.” In that article he also uses the analogy of a doctor:

The first thing a doctor does at an appointment is listen. The doctor doesn’t talk to me about where he went to medical school or pull out degrees to prove to me that he’s qualified. He certainly doesn’t explain that he has access to a variety of triple-A-rated medicines that I may need. He asks very simple questions. How are you feeling? What sorts of things are troubling you? Where does it hurt?

Financial advisers can ask very similar open-ended questions to get clients talking about how they really feel. This is not the time to have clients fill out a 97-point checklist with all of their personal information. This is a time to talk about feelings and to listen. Many expert consultants in the financial services industry offer recommendations on conducting this interview. Some great questions include:

- If you could paint a picture for me of your average day in retirement, how would you explain it? Who would you spend your time with and what would you do?

- If you see one major roadblock between you and the picture you painted for me, what would that roadblock be, and what do you feel stops you from overcoming it?

- What is one financially related thing you lose sleep over?

- If you had my job as a financial adviser for a day, what area would you begin researching right away and why?

- What are your professional and personal aspirations?

These are great ‘life-planning’ type of questions, and they are the type of questions your financial advisor should be asking, and helping you to answer.

To find a comprehensive financial planner in your area, go to the National Association of Personal Financial Advisors.