It’s time to consider adjusting your retirement savings. The Internal Revenue Service recently issued a variety of inflation adjustments for 2013, and retirement savers can now save even more.

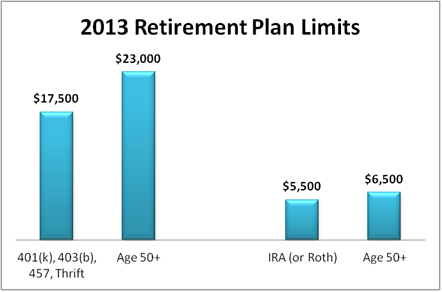

Beginning with the 2013 calendar year, participants in 401(k), 403(b), and governmental 457 or Thrift plans can now save up to $17,500. This is a $500 increase from 2012. Those age 50 or older can save an additional $5,500 as a catch-up provision for a total limit of $23,000. This catch-up ceiling is unchanged from 2012. (click here to see limits from prior years)

Small business owners will be able to save up to $51,000 in a SEP IRA or Solo 401(k) or up to $56,500 for those age 50+. This is also the maximum that can be added into a traditional employer-sponsored 401(k) through the combination of employee and employer contributions.

Many will not be able to max out their retirement account, but everyone should consider increasing their savings amount next year. For some people, this means increasing the percentage of their salary deferral. Do whatever you can do to get the full matching amount.

Some 401(k) plans have begun using an auto-increase option that automatically increases the savings percentage each year. This feature became available after a number of studies suggested that most people are too lazy or distracted to ever adjust their savings elections after their initial enrollment.

Go ahead and make your New Year’s resolution today. You can go online or contact your Human Resources Department now and request an increase in your salary deferral beginning with your first paycheck in January. They will appreciate the advance notice.

The most basic retirement savings goal is to save 10% of your pretax salary and bonuses. After receiving your company match, Roth IRAs are the next best place to save. Roth IRA maximums are increasing to $5,500 in 2013 or $6,500 for those age 50 or older. The upper income limits for eligibility begin phasing out at $178,000 of adjusted gross income (AGI) for married couples, a $5,000 increase from 2012. Singles are capped at $127,000. Those who earn more should consider a backdoor Roth IRA contribution. That’s where you convert a taxable investment account to a Roth. There are no limits on Roth conversions.

Our recommended method of setting your retirement savings goals is based on a percentage of your lifestyle spending. The closer you get to retirement, the more precise your retirement savings goals need to be.

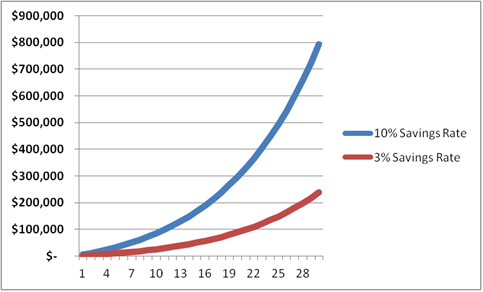

The difference between saving 10% of your salary and 3% of your salary is over half a million dollars for an employee who starts out making a salary of $50,000.

In both cases, I assume the portfolio returns 8% a year and your salary increases by 3% a year. It will not be long before a million dollars will be considered the bare minimum needed for a reasonable retirement lifestyle.