We often ask clients for their tax returns so we can see what tax bracket they are in, and we ask our clients to let us know if they expect this year’s taxes to look like last year’s. Looking at their tax return allows us to plan ahead in our trading.

We often ask clients for their tax returns so we can see what tax bracket they are in, and we ask our clients to let us know if they expect this year’s taxes to look like last year’s. Looking at their tax return allows us to plan ahead in our trading.

Some people have a “buy and hold” investing philosophy, but as we have written elsewhere, we have a “buy and rebalance” philosophy. This means that we use free cash to invest in what has gone down and needs to be brought back to the target range, but it also means that we want to be able trim some gains as part of rebalancing.

We might want to trim a position that has gone up quite a bit because we don’t know if it will keep going up or not, and selling at a current higher price allows us to “lock in” the gains and rebalance the portfolio (selling high and buying low!).

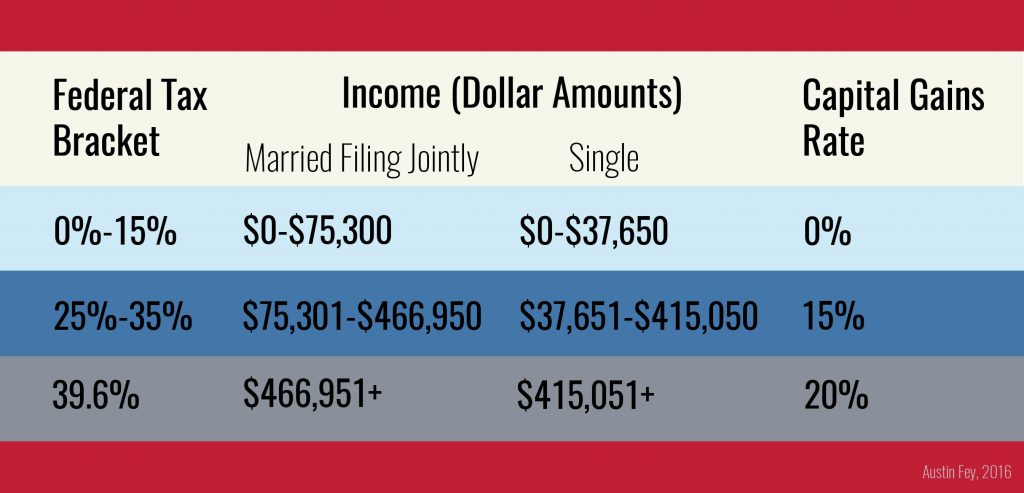

When you sell an investment that has appreciated, the IRS looks at your tax rate and taxes the gains accordingly. If you are in the 0-15% federal tax bracket, your capital gains rate is 0%. If you are in the 25-35% tax bracket, your capital gains rate is 15%. If you are in the 39.6% tax bracket, your capital gains rate is 20%.

For our clients in the higher tax brackets, it is difficult to sell highly appreciated stock unless we also pair it with a capital loss because the tax consequences are steep. If we realize equal values of gains and losses, they will cancel each other out, and we can get rid of some losers in the portfolios and take the top off some of the winners.

If we realized some capital losses for a client that we did not pair against gains in a previous year, they may have a carryforward. We can use up to $3,000 of a carryforward per year against gains in an account without creating a tax liability.

But for clients in lower tax brackets, we can gradually trim gains up to the top of the tax bracket they are in. If we realize too many capital gains in one year, we risk sending their income over into the next tax bracket and incurring capital gains tax, so there is a sweet spot which we carefully calculate the range based on taxes of the previous year and a client’s estimate of any differences in taxes for the current year.

Even in some of the middle or higher tax brackets, it might be worthwhile to trim a few capital gains to rebalance the portfolio. As we like to say in the firm, “it’s always a good time to have a balanced portfolio.”

Photo used under Creative Commons Zero license. Chart by author.