Q: Do you recommend dividend paying stocks? If not, what investment strategy do you recommend for retirees who are seeking income from our portfolios?

Sincerely,

Income Seeker

$ ?s answered by Matthew Illian, CFP®

Dear Income Seeker,

The Federal Reserve’s policy of actively manipulating borrowing rates shoulder much of the blame for the fact that retirees can only receive a yield of 2% in 10-year Treasury notes and often less in CDs or their savings accounts. Some have called this monetary effort a “war against savers.” In this interest-starved environment, a focus on maximizing dividend income is susceptible to hidden risks .

A dividend is a cash distribution from a corporation to an investor. When firms make dividend payments, the stock price will decrease by an amount roughly equal to the dividend paid. For example, an investor holding 10 shares of a stock priced at $100 per share has a total account value of $1,000. If the stock pays a dividend of $5 per share, the stock price would generally drop to $95 leaving $950 in stock and $50 in cash. Taking the dividend payment in cash for spending purposes actually reduces the principal value of the account.

Dividend investors are too easily lulled into the temporary comforts of portfolio income. They are being fooled by the financial media which tout a “conservative and stable” dividend income strategy. Many are overlooking the great risk that inflation poses to the dividend investor.

Retirees who consider their portfolio income to be their retirement wage are the most susceptible to the devastating effects of inflation. Both workers and retirees are affected by the “hidden tax”. However, portfolio income generated by dividends is less flexible than workers’ wages. Employees can generally demand an increase in their pay during periods of inflation. In fact, many jobs have automatic increases that match the Consumer Price Index (CPI). The same cannot be said for portfolio income.

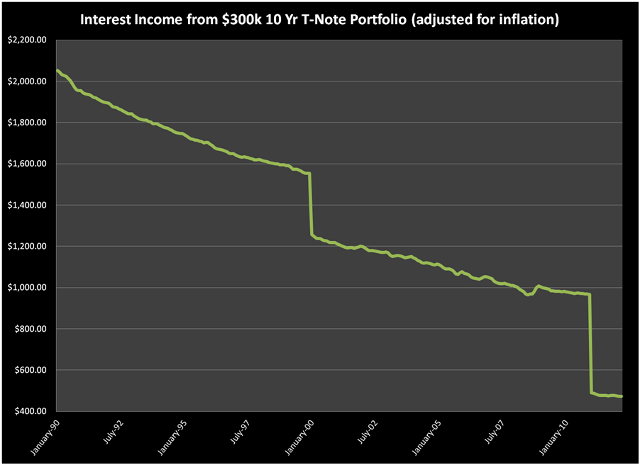

Retirees who plan to live off portfolio income each year are experiencing a slow drain on their standard of living. As a stark example, consider a retiree who started investing in a $300,000 portfolio in 10-year Treasury-notes in January 1990. This portfolio began yielding $2,052.50 in monthly interest payments. The same portfolio only yields $847.50 at today’s dismal rates, and when inflation that has occurred over this time is factored in, this is a 1990 purchasing power of $472.21. You can see the impact of the “hidden tax” in this chart:

The downward slope in this trendline is due to inflation. And this snapshot was taken during a twenty year period of unusually muted inflationary effects. If I had included the 70s and 80s, the impact would be multiplied. The large jumps down in income are due to falling reinvestment rates that occurred at each 10-year maturity date of these notes.

Instead of focusing on portfolio income, we advise our retirees to focus on a safe withdrawal rate (SWR) from their portfolio. The SWR anticipates inflation but is independently calculated from any income generated by the portfolio. Your goal should be to start with a withdrawal amount that will be able to keep pace with inflation and last you well into your golden years.

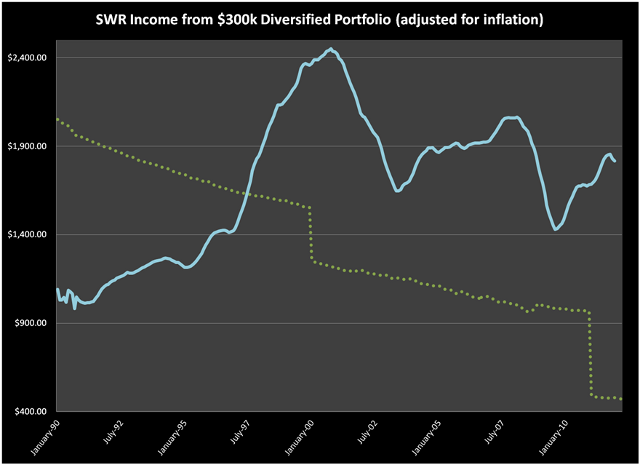

The next chart represents inflation-adjusted monthly income from a diversified portfolio. It assumes the investor has 70% invested in the S&P 500 and 30% invested in the Barclay’s aggregate bond index. An important fact from this simple experiment is that while the income started lower, it averaged $330 more during this 22-year test period. More importantly, the retiree’s standard of living increased over time, which is a significantly more tolerable strategy. This increasing standard of living is illustrated by the positively sloped blue line representing monthly income.

The average monthly income for the SWR investor was $1,695 but only $1,364 for the income investor. The other item to consider, not represented on the chart, is that the SWR strategy left the retiree with a portfolio value of over $500,000 after 22 years of distributions, but the income investor only had the original $300,000.

An intelligently diversified retirement portfolio will not seek dividend paying stocks to the exclusion of other growth opportunities. Such a strategy would have missed the opportunity to invest in Apple stock which has only recently declared a dividend. Warren Buffet’s Berkshire Hathaway has never paid a dividend. These companies prefer to reinvest company earnings back into their business channels and seek to expand the company stock value.

We recommend a dividend neutral investment philosophy. Instead, we focus on a total return policy that looks for portfolio growth wherever it may be found.

To avoid getting swamped by expected inflation, expand your investment options to companies that reinvest earnings into new business ventures in addition to those that distribute earnings back to investors. Consider talking with a fee-only financial advisor about a total return approach to investing.

If you have a money question that is nagging at you, please submit it using our contact page. We try to respond to every question. If yours is chosen for MONEY QUESTIONS, we will give you a pseudonym and let you know the date the Q&A is published.