I have had five speaking engagements at the local chapters of the American Association of Independent Investors (AAII) in Florida during a three day trip. I am a life member of AAII and part of their speaker’s bureau. This is a wonderful opportunity and I’d like to invite any of our subscribers in The Sunshine State to attend one of the following events as our guest: You can still listen to one of these presentations if you…

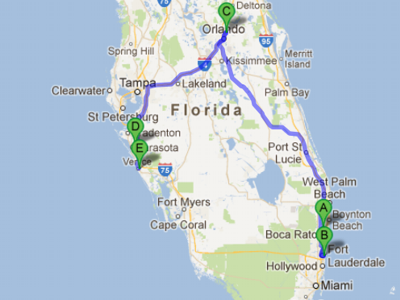

(A) Southeast Florida AAII Chapter (Delray Beach, FL)

Tuesday, February 19, 2013, 7pm – 9pm

PBC South County Civic Center, 16700 Jog Rd., Delray Beach, FL 33446

more information…

(B) Southeast Florida AAII Chapter (Fort Lauderdale, FL)

Wednesday, February 20, 2013, 10am – noon

Charles Schwab, 500 East Broward Blvd., Suite 101 (first floor), Fort Lauderdale, FL 33394

more information…

(C) Central Florida AAII Chapter (Winter Park, FL)

Wednesday, February 20, 2013, 6:30pm – 8:30pm

University Club of Winter Park, 841 N. Park Ave., Winter Park, FL 32789

more information…

(D) Southwest Florida AAII Chapter (Sarasota, FL)

Thursday, February 21, 2013, 2pm – 4pm

Homewood Suites, 3470 Fruitville Road, Sarasota, FL 34237

more information…

(E) Southwest AAII Chapter (Venice, FL)

Thursday, February 21, 2013, 7pm – 9pm

Venice Community Center (VCC), Room F, 326 S. Nokomis Ave., Venice FL 34285

more information…

There is a $5 fee. Full-Time Students with ID are free. If you would like to come as our guest, please let us know and we put you on a list and pay the fee for you. I highly recommend AAII. It is a wonderful group for those who want to learn more about investing.

And here is what I will be speaking on:

“Dynamic Portfolio Construction in the Context of Comprehensive Wealth Management”

Wealth Management is based on the principle that small changes that can yield enormous gains over time. We will look at portfolio construction in the context of comprehensive wealth management. And we will see how to integrate aspects of your finances to best meet your life goals.

ATTEND THIS PRESENTATION TO LEARN:

- How to balance risk and return, and what risks should you really be worried about.

- How to boost returns through static and dynamic asset allocation.

- How to craft a portfolio in the midst of growing European and U.S. sovereign debt.

- How to integrate tax management and estate planning into your investment plan.

- How to order your portfolio around your life goals

REASONS TO ATTEND:

- Small changes that can yield enormous gains over time

- Investors need an investment philosophy which is both simple and adaptive.

- The next five years may be one of the times when a strong tilt toward specific sectors or countries may provide superior long-term returns.

- Going forward, tax management may be more important than investment management to your finances.

- Now is the time to start with your goals and design a financial plan around them rather than the other way around.

SPEAKER’S BIOGRAPHY:

David John Marotta, is President of Marotta Wealth Management, Inc. A graduate of Stanford University, Marotta writes MarottaOnMoney.com, a weekly financial column and daily financial blog and has been published or quoted on financial matters in many major publications including Forbes.com, The Washington Post, The LA Times, The Miami Herald, Dow Jones Newswire, Dow Jones MarketWatch, Fidelity Wealth Management Perspectives, Investment Advisor Magazine, NAPFA Planning Perspectives, The Virginia Institute, The Jacksonville Business Journal, and The Charlottesville Daily Progress.