True life planning begins when you realize you are unique. There will never be another you in the history of the universe. Your calling is yours alone. Understanding yourself is the first step in managing your financial affairs to support your life plan.

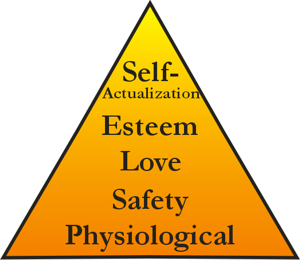

Studies show that people think about money as a pyramid similar to psychologist Abraham Maslow’s hierarchy of needs. Our first priority at the base of the pyramid is hand to mouth, meeting our physiological needs. Next we seek safety and security with enough money to support our health and well-being against accidents or illness and to save for infirmity in our old age.

Having the money to meet these basic needs really does bring a certain degree of happiness. It is almost impossible to experience contentment if your basic requirements for human survival are not being met or your personal or financial security is in jeopardy.

A new study from Angus Deaton and Daniel Kahneman of Princeton University’s Woodrow Wilson School puts a price tag on such happiness at $75,000 a year. Their study concludes that high income buys life satisfaction but not happiness. Happiness is measured by emotional well-being and the frequency and intensity of the joy, fascination, and affection or anxiety, sadness, and anger that make our lives pleasant or unpleasant. Happiness increases with income to about $75,000 a year, and then it plateaus.

Life satisfaction, in contrast to happiness, refers to our beliefs about our lives. The two are very different. In reference to Maslow’s hierarchy of needs we might achieve greater life satisfaction by succeeding in the third level of his pyramid: love and belonging.

Economists David G. Blanchflower and Andrew J. Oswald have even measured the economic value of marriage. They claim it takes about $90,000 more annually to equal the happiness associated with a good marriage. Getting divorced can be equated with losing $23,000 annually. And becoming widowed hits even harder. It is like losing $41,000 a year.

The financial blow of being married and then being divorced or widowed equates to a loss of $113,000 to $131,000 of annual income. That means a little money spent taking care of our spouse or our marriage is well worth it.

Having financial resources beyond survival frees you to use money as a way to express care and concern for those you love. And while this may not increase your happiness, it does increase your life satisfaction.

Life satisfaction also increases as money is available for the final two stages of Maslow’s hierarchy of needs: esteem and self-actualization. Esteem is the need we have to respect ourselves and for others to find us worthy. We have a desire not just to achieve financial success but also significance in the world. We want to make our mark, and money well spent can have a major impact on the lives of others.

This month at MarottaOnMoney.com we have invited several money mavens to answer this simple question: “What is one of your favorite things that you’ve been able to do with your money?” Their answers are just a small part of the significant things that money can accomplish. We offer them as inspirational examples of financial life planning. You will discover how money can be used to express love, help others or realize dreams.

Studies of life planning show that these goals often fall into one of three areas. Family is by far the most common life goal. For many, the ideals of family extend to communities that have had an impact on our lives or even humanity as a whole. A second realm where people find significance is authentic spirituality. This is more than simply being religious; it involves the totality of our life in which we seek a power greater than ourselves to help us renew and shape our very identity. Third is the arena of beauty such as music, the visual arts or creative writing. For others, a sense of awe is found in a reverence for nature.

We invite you to share your own favorite things to do with money on our website. The examples are as unique as the individuals, but they are offered in the hope that they will remind you that money is more than dollars and cents. It can be an extension of you and your values.

Maslow’s peak need is self-actualization, another way of saying you know who you are and understand your place in the universe. You appreciate your unique role and area of genius and are able to be who you were meant to be. What you have dreamt for yourself has come true.

People who live their lives this way will have no regrets. Structuring your finances around your self-understanding is what life planning is all about.