Debt Talks Target Cost Of Living – Social Security Falls Further Behind

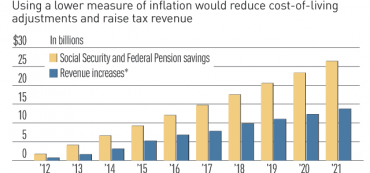

To solve the deficit reduction riddle, Obama reportedly is embracing an idea that purports to raise tax revenue without a tax hike and claims to cut Social Security outlays without cutting benefits. Better check your wallet.