In 2022, the United States dropped to its lowest score ever in The Heritage Foundation’s Index of Economic Freedom.

In 2022, the United States dropped to its lowest score ever in The Heritage Foundation’s Index of Economic Freedom.

While many subscores saw large increases, it was the steep drop in fiscal health which pulled down the overall score of the United States.

Here is the way the author’s of the Index of Economic Freedom described the United States :

The 2020 pandemic throttled relatively solid economic growth that had been stimulated by tax cuts and a lightened regulatory burden. Unfortunately, unchecked deficit spending and unprecedentedly accommodative monetary policy not only continued, but also accelerated in 2020 and 2021.

It was this “unchecked deficit spending” which has ruined the United State’s fiscal health.

U.S. Debt

Fiscal policy refers to the decisions made by Congress and the President to tax and spend. These decisions to boost government consumption and make transfer payments undermine overall productivity growth. Fiscal policy directly influences fiscal health. Unchecked deficit spending results in an ever-increasing public debt.

As the Corporate Finance Institute wrote:

A high debt-to-GDP ratio is undesirable for a country, as a higher ratio indicates a higher risk of default. In a study conducted by the World Bank, a ratio that exceeds 77% for an extended period of time may result in an adverse impact on economic growth. It was indicated that each additional percentage point of debt above that level reduced annual real growth by 1.7%. For reference, the USA’s debt-to-GDP ratio was 105.40% in 2017. Therefore, when the ratio is high (>80%), a country is likely to exhibit a slowdown in economic growth.

The U.S. debt was massive in 2017 and has only grown. In the 2022 Index of Economic Freedom, The Heritage Foundation reports that for the United States :

Government spending has amounted to 38.9 percent of total output (GDP) over the past three years, and budget deficits have averaged 9.0 percent of GDP. Public debt is equivalent to 127.1 percent of GDP.

The United State’s debt-to-GDP ratio jumped in 2020 and 2021 bringing us to one of the world’s most indebted countries. We have joined the PIGS (Portugal, Italy, Greece, and Spain) as well as Japan. Here is a list by debt-to-GDP ratio: Venezuela, Japan, Sudan, Greece, Lebanon, Cape Verde, Italy, Libya, Portugal, Singapore, Bahrain, United States, Mozambique, Bhutan, Angola, and Spain.

Inflation

Inflation is measured by a rise in prices but it is not the rise in prices. As Investopedia explains, inflation is “the decline of purchasing power of a given currency over time.” Inflation is not the result of corporate greed or profiteering but rather is primarily a monetary matter. More dollars chasing fewer goods. And who controls the currency to create this problem? There is only one entity: government.

Americans are generally unfamiliar with the purchasing power of our currency fluctuating wildly. In 2008, the value of a dollar increased sharply as financial institutions needed to raise cash. The resulting drop in the stock market as these financial institutions sold their massive portfolios could be anticipated. It was also short-lived. Six months after the bottom, the markets had recovered most of their value. Now cash is being devalued as the money supply is being expanded. This is what is meant by “inflation.”

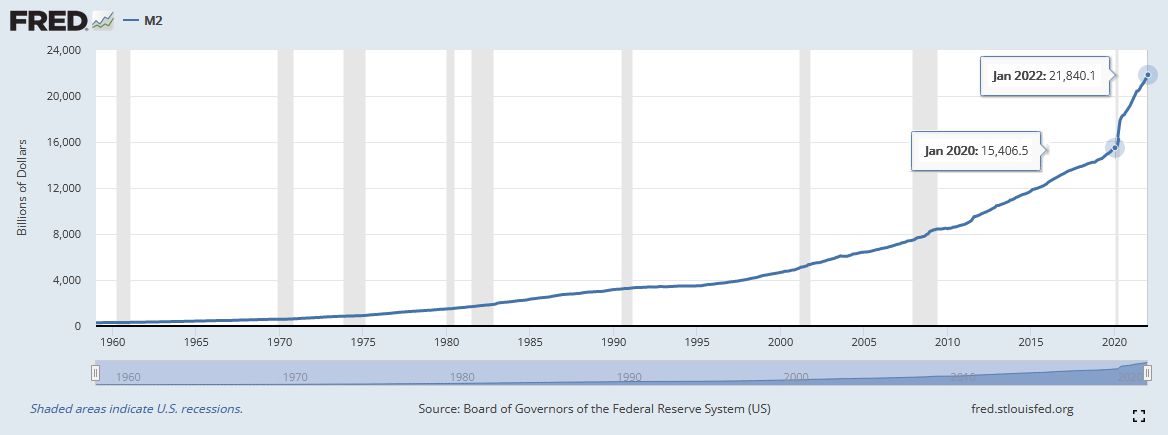

Here is a graph of the federal reserve’s measure of money, M2:

Shockingly, 41.76% of the money we have ever printed has been printed since 2020.

Jeff Stein and Rachel Siegel of the Washington Post recently wrote, “What should the White House do to compact inflation? Experts weighed in with 12 ideas. ” Touted as “independent experts from across the ideological spectrum”, the proposals had one correct answer from Brian Reidl of the Manhattan Institute (#2 Stop the spending) to 11 incorrect answers. Let’s look at these incorrect answers to learn how liberals deal or refuse to deal with objective data.

- Make America produce again. As though government can make people produce. If this were possible, why doesn’t government always make people produce? Government tends to find a parade and then get out in front of it in order to take the credit. Instead, government should simply get out of the way.

- Control the COVID pandemic. Governmental efforts to “control” the pandemic with its one-size fits all legislation have largely not worked. The government has always been concerned with their own agenda including the supply of N95 masks, production, taxes, and hospital capacity. Government officials have had one rule for themselves and another for everyone else. Liberals routinely blame unvaccinated people for their disease, but this is blatant schadenfreude. With the underlying science evolving daily, can’t we just assume that everyone is trying to do the best they can for what they are responsible for?

- Invest in child care. Government investment in child care is simply offering a new entitlement program so that parents can join the workforce. This is their way of making child care affordable. But perhaps encouraging child care younger than six years old is counter productive. As the CDC says , “The early years of a child’s life are very important for his or her health and development. … Having a safe and loving home and spending time with family―playing, singing, reading, and talking―are very important.”

- Tax wealthy investors. “Tax the rich” is a powerful mantra among liberals. But the United States already has one of the most progressive tax codes in the world. The Nordic countries reach their top tax rate around $90,000 per year while the United States doesn’t reach its top tax rate until $540,000. If you’re not an economist, you may vastly underestimate the negative impact of taxes on the U.S. economy. And of course, taxing the rich has little to do with inflation.

- Prepare for Fed intervention, de-escalate the trade war. This is mixed advice: “Biden’s appointees should have as their top priority maintaining stable prices, not addressing racial inequity or risks from climate change”. But the nomination of Sarah Bloom Raskin to Serve as Vice Chair of the Federal Reserve won’t help inflation simply because the Federal Reserve handles monetary policy not fiscal policy.

- Improve America’s supply chains. Certainly, but how can the government improve America’s supply chain? Mostly by deregulation and getting out of the way. Government regulation doesn’t make you safer. But supply chain issues still leave the country’s fiscal policy intact.

- Inflation is a wildly overblown attempt to stop progressives. Inflation is a real and present danger.

- Use antitrust to curb corporate profiteering. There is no reason to suggest that corporate greed is any greater now, nor is it even a secondary cause of inflation.

- Make expectations realistic. In other words, admit that inflation is higher and be honest. Honesty is better, but honesty doesn’t help solve inflation.

- Drive down health-care costs. Supposed government will exercise greater restrain in government spending and bargain harder. Since the passage of ObamaCare in 2010, healthcare insurance premiums have continued to skyrocket. No amount of bargaining harder will solve the systemic problems built into the ObamaCare legislation. And since healthcare insurance costs have continued to go up by more than inflation, it certainly won’t solve inflation.

- Consider using price controls. Price Controls are never good economics.

Other than “stop spending”, none of these ideas will fight inflation.

What do we do?

Inflation is not something that you can just wish away. It is a fiscal and monetary formula that ultimately affects the purchasing power of everyone’s cash.

Inflation may drop from its current 7.5% down to something around 4.0%. The government will take credit for “lowering inflation” but the appearance of lowering will be recency bias.

At 4.0% inflation, cash will lose 82.88% of its value over 45 years. Such loss of value can ruin a retirement plan more so than any market returns. Your long term investments need to appreciate well over inflation. The best method to do that is to stay mostly invested in stocks.

Photo by Craig Tidball on Unsplash