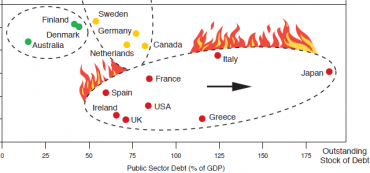

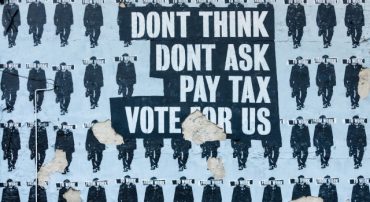

Personalizing the Debt Shows it is Unsustainable

Our country’s debt and deficit is difficult to understand in the abstract. Translating it to the numbers on each taxpayer’s credit card can help us see how our country’s spendthrift ways have debilitated economic productivity.