We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Video: Foreign Freedom Investing

Countries with the most economic freedom generally do better than the international index.

Safeguard #7: Avoid Investment Advisors Who Sugarcoat Reality

Excellent advisors communicate clearly exactly how bad the markets have been and can be.

Investment Strategies Part 4: Don’t Rebalance at the Sector Level

Rebalancing between asset classes boosts returns and decreases volatility. But setting your asset classes based on sectors of the economy is not an effective strategy.

Radio: Behavioral Finance

David Marotta discusses behavioral finance.

Investment Strategies Part 3: Rebalance Regularly Between Asset Classes and Subcategories

In this formula is deep wisdom, both for portfolio construction and for determining which categories are worth regular rebalancing.

Video: June: The Month of Wedding Financial Planning

Couples getting married in June usually don’t take the time for pre-marital financial counseling. Yet much of the friction in marriage stems from different financial perspectives, and how money is handled is often a factor in divorce

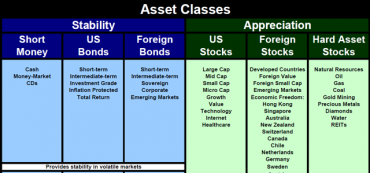

Investment Strategies Part 2: Use Correlation to Define Asset Classes

Generally, a correlation that can drop below 0.6 with other asset classes is a good candidate to become its own asset class.

Investment Strategies Part 1: Rebalance into Stable Investments in an Appreciating Market

Diversifying your portfolio means finding assets that have value on their own merits but do not move exactly alike. A critical investment metric called “correlation” is used to construct a portfolio most likely to meet your personal financial goals.

Achieving Family Harmony in Estate Planning Part 2: Make Sure Your Plan Fits Your Unique Needs

Estate planning must begin with family harmony as the goal. Thus personal dynamics are more important than avoiding probate and estate taxes.

Radio: Learning To Live On Your Own

David Marotta discusses learning to live on your own after college.

American Mercantilism Descends Into Fascism

The government is not intervening out of a sense of altruism.

Achieving Family Harmony in Estate Planning Part 1: Leave Your Estate in the Right Hands

The most important product of estate planning is achieving family harmony. Think carefully when you choose your executor or trustee.

Video: What’s More Important, Saving for College or Retirement?

What’s more important, saving for college or retirement?

Video: Roth Segregation Part 1: IRA Tax Law

A complex technique called “Roth segregation accounts” could earn your investments an extra 30% over the next two years.

Roth Segregation Accounts

A complex technique called “Roth segregation accounts” could earn your investments an extra 30% over the next two years.