We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Stop-Loss Orders Can Lose Money Quickly

Thousands of investment advisors recommended stop loss orders to their clients. Now it looks like this advice may have been the cause of the May 6, 2010 market plummet.

Now’s Still the Time to Buy a House

Everyone is expecting real estate to underperform the stock market for many years going forward.

Should You “Sell In May And Stay Away”?

When the saying first circulated, May was flat. Since 1987, however, May has done phenomenally well, averaging 2.11%.

Appreciating Assets Part 2: Other Investments

Your investments should be working for you, appreciating more than inflation to become an engine of growth that pays you money and provides some measure of financial freedom.

The Fragility Of Freedom At 60%

In just three short years we’ve added more to the deficit as a percentage of GDP than in the three decades before.

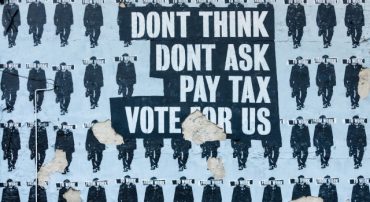

The Fragility of Freedom at 60%

In 1977 economist Milton Friedman wrote an article “The Line We Dare Not Cross: The Fragility of Freedom at ‘60%.'” We are in danger of crossing that line.

Radio: Taxation and Inflation

David Marotta discusses how to shield your personal assets from the corrosive influence of government policies.

Appreciating Assets Part 1: Stocks and Bonds

All assets are not equal. Some investments appreciate better on average than others.

ObamaCare Is the Worst Legislation in 75 Years

Everyone in our risk pool will order filet mignon. First the costs will skyrocket. And then the meat will be rotten.

Avoid Budget Busters Part 4: Budgeting Pitfalls

Sometimes we make the mistake of deliberately budgeting the impossible. If you purposefully set the required spending in one category too high, you won’t be able to trim other categories to bring your overall spending into harmony.

Avoid Budget Busters Part 3: Plan on Budgeting Surprises

Many budgets are doomed to failure because of the challenge of planning for unplanned spending. Here are some of the items you either did not put in your budget or they shouldn’t be in your spending.

Radio: George Marotta’s Experiences And Career

George Marotta is a research fellow at the Hoover Institution pursuing research on international finance.

Avoid Budget Busters Part 2: Curb Your Worst Impulses

Get control of the spending that breaks the bank. Certain purchases that are typically both unnecessary and unplanned are budget busters. Avoiding these financial slips requires hedging some of our worst impulses and constraining our desire for instant gratification.

Video: How Your Children Can Win the Stock Market Game

Good things do come from France. Frenchman Antoine Deneriaz captured Olympic gold in the men’s downhill skiing event beating out favorites Austria’s Michael Walchhofer and America’s Bode Miller. His win meant flying madly off jumps and being determined to finish first or break every bone in his body. Your investments shouldn’t be like that.

Video: Personal Debt – The Borrower Becomes The Lender’s Slave

They say that as long as Americans keep spending, the economy will be strong and unemployment will remain low. “Spend now and pay later” is poor personal policy.