We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Money Questions: Tips for College Freshmen

Q: Our son is headed to Virginia Tech as a college freshman. When it comes to finances, he’s clueless. What financial advice should we offer before we drop him off?

An Appetizing Investment

High Net Worth individuals are often solicited to provide funds for a private venture such as opening a new restaurant business. Think thrice before considering investing.

Means-Test and Privatize Social Security

If you look at Social Security as a system of taxation and redistribution, it takes from a single minority male worker and gives to married white women who never contributed. And if you look at Social Security as a forced retirement savings program, it produces such a terrible return we might as well invest in gold. Neither perspective is worth continuing. Social Security as we know it needs to be abolished.

Fee-Only Financial Planners Help You in Three Ways

Working with a fee-only planner can help you make better financial decisions and balance current needs with future goals. The result can be financial peace of mind.

Mailbag: How Can There Be More Sellers Than Buyers?

How can there be more sellers than buyers? Who are those “extra” sellers selling to?

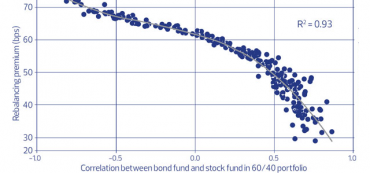

The Rebalancing Premium

When choosing between two bond funds with similar returns to team with a stock fund, choose the bond fund with lower correlation with the stock fund you’re selecting

Neither Rationale for Social Security is Working

Social Security has been called the third rail of politics. Good thing I’m not a politician. Someone has to make the tough decisions.

Retirement Plans’ Perilous Future

Between threats of cutting tax benefits and crackdowns on non-compliant plans, for the retirement industry ‘stakes are higher than they ever were’

Can Financial Advisers Be Trusted?

Not every investment consultant has your interests as the top priority, or even the necessary credentials. Here’s how to find the right type of adviser.

How to Maximize Long-Term Returns

I recently read two articles that provided insight on how investors should respond to a market downturn.

Which Rich Are You Trying to Tax?

Those productive small business owners with higher earnings are a different group from the ultra-wealthy with higher net worths.

The GAO Makes A Poor Financial Advisor

If the GAO were giving you investment advice they would suggest that you not participate in your 401(k) and convert at least half of your retirement savings into an annuity laden with fees and expenses.

Freedom Investing

Given the dangers of worldwide sovereign debt, this may be one time when investors should continue to tilt foreign and toward specific countries.

Video: The Dangers of Immediate Fixed Annuities

The returns offered by immediate fixed annuities aren’t as good as they sound. The sleight of hand in this case is the immediate loss of 100% of your principal. They are fixed for you to lose and the insurance company to win.

Motivating and Helping the Overspending Client

Most financial planners have a difficult time helping clients reduce their spending habits and start saving.