We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

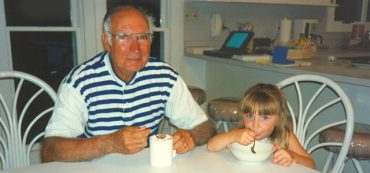

Rich Dad, Rich Son, Rich Granddaughter

George Marotta, also known as “Papa” to me, is quite a fount of wisdom and knowledge. In this post, I give you Papa Marotta and a little bit of wisdom I managed to get him to share on grandchildren.

Leah E. Hughes: Staying Calm When Markets are in Turmoil

I can’t control the markets, but I can focus on what is important.

$ ?s: The Gift that Keeps on Giving

Q: We plan to use appreciated stock for charitable giving and are looking into using a Schwab Charitable Fund. Do you have any feedback on this strategy?

Jennifer Lazarus: Magnify the Impact of Our Money

We’ve made contributing to microfinance a part of our annual charitable giving and in lieu of gifts to one another.

Scott Leonard: Purchase the Property Used for the Business

The best money decision I have made is purchasing the property I use for my business. The advantages are far greater than those of owning vs. renting a home.

Economic Lessons from Farmville

To interest me, a game must have a simple but thought-provoking premise that allows for deep strategy. I’d never played Farmville but decided to recently because the parent company, Zynga, is going public this Thursday, December 15, 2011.

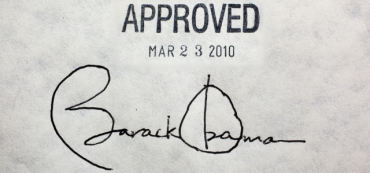

Obama Care is Costing Americans $384 Billion More Each Year

The “Patient Protection and Affordable Care Act” (PPACA), is misleadingly named. It has neither protected patients nor made healthcare more affordable.

Rich Dad, Empowered Daughter

With impulses reeling, it is easy to find a gift that children will appreciate but difficult to find one that they will love to have. The gifts that I loved to have and the presents that I still cherish are the vocational gifts that my parents purchased for me.

Manisha Thakor: The Joy of Sleeping Well At Night

“Sleeping well at night knowing our household is 100% debt free is truly priceless.” – Manisha Thakor, personal finance expert & author.

$ ?s: Gifting to the Grandchildren

Q: I inherited shares of five stocks from my parents, who died many years ago. I am now 70 years old and would like to gift them to my grandchildren. How do you recommend I do this?

Holly P. Thomas: View from the Porch

“Sunrises in my rocking chair, sipping coffee and watching the fog unveil each day.”

A Wealth of Satisfaction

True life planning begins when you realize you are unique. There will never be another you in the history of the universe. Your calling is yours alone. Understanding yourself is the first step in managing your financial affairs to support your life plan.

Rich Dad, Amused Daughter

Fun has no price tag and cannot simply be ordered online plus $3.99 shipping and handling. It’s true that money can enable experience but it cannot replace it. There is an art to having fun and it needs to be taught.

David John Marotta: Solve the Problems Which Money Can Solve

Even though money was tight, having margin in our budget for unknown unknowns kept us from punishing a student simply because they lacked experience bidding painting jobs.

Matthew Illian: Spending Money Never Tasted So Good

Just a few weeks ago, my wife and I were going to join a diverse group of friends for dinner. My wife said we would bring dessert but on the day of the event, there was no time for baking.