We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

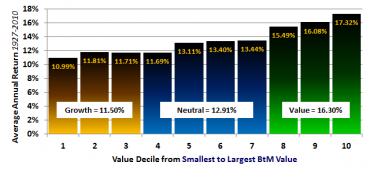

Value: The Third Factor of Investing

A stock’s valuation is measured on a continuum from “value” to “growth” In broad strokes, value stocks are cheap and growth stocks are expensive.

How Do I Allocate Investments with Capital Gains Among Taxable and Traditional IRA Accounts?

There is a distinction between existing high capital gains exposure in a mutual fund verses future capital gains you expose yourself to.

Before You Say “I Do”: Money & Marriage Exercise 5

My wife and I have six of our eight grandparents who are living well into their 80s and 90s.

Safeguarding Your Money

Given all the greed and deceit in the world of financial services you shouldn’t have to trust your financial advisor. Here is a list of eight safeguards that should be in place to help safeguard your money.

Before You Say “I Do”: Money & Marriage Exercise 4

Many people turn to religion when defining these shared values.

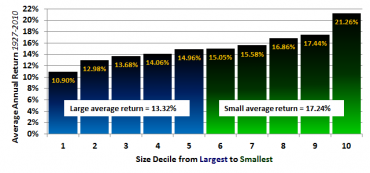

Size: The Second Factor of Investing

The second factor of investing is size as measured by a stock’s total capitalization. Over time small cap will outperform large cap even after factoring out measurements of volatility.

Before You Say “I Do”: Money & Marriage

Couples that fail to prepare for a shared money maturity will likely experience longer and sharper growing pains. Here are several things to talk about before tying the knot.

Reconciling Couples’ Money Differences

Many couples have significant issues about money. Many people’s beliefs are holding them back from enjoying life to its fullest potential. Make sure someone asks you the right questions.

Before You Say “I Do”: Money & Marriage Exercise 3

I highly recommend that you plan to live on one salary for the first several years. This is a challenge that too few couples accept.

Social Security Planning from the 2012 January / February issue of Planning Perspectives

“Deciding when to take Social Security benefits is critically important to maximizing long-term benefits. Benefits may be claimed as early as age 62, or as late as 70.”

Before You Say “I Do”: Money & Marriage Exercise 2

Begin by reflecting on this question: “Imagine you are financially secure, that you have enough money to take care of your needs, now and in the future.

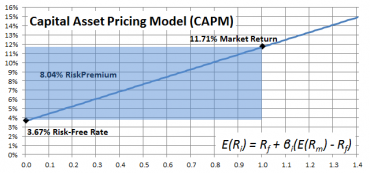

CAPM: The First Factor of Investing

Modeling investment returns seeks to find an equation to predict your expected returns as much as possible. The simplest equation for the markets would be “Return equals 11.71%.” This has been the average return from 1927 through 2010, the zero factor model.

Sound Advice for Our Times from 1946

“Economics in One Lesson” by Henry Hazlitt is one of the classics which should be required reading before voting. It is interesting to see that he knew more in 1946 than the politicians of our age.

Is Money Pulling You Apart?

Financial troubles and marital troubles go together. Does financial largess therefore also go with marital harmony? Do something romantic together: Engage a fee-only financial planner.

Radio: How To Get Thousands More Out Of Social Security

David John Marotta and Matthew Illian discuss how to get more from Social Security by filing at the right time and taking benefits at the right time.