We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Investing Edition–Wealth Management Carnival #6

This week’s carnival is concerned with investments, investing styles, and how to stay focused. There are just about as many investing philosophies as there are investors, so read a range of opinions and form your own.

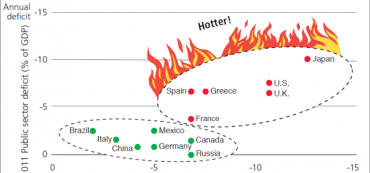

The Ring of Fire – Part 2

“Unless we begin to close this gap, then the inevitable result will be that our debt/GDP ratio will continue to rise, the Fed would print money to pay for the deficiency, inflation would follow, and the dollar would inevitably decline.”

Contributing to Multiple Retirement Plans ($ ?s)

This article reviews the coordination rules which govern the maximum contributions to 457, 401(k) and Thrift Savings Plan. Information on 403(b) plan maximums is also included.

Giving Gifts to the Wrong Beneficiaries–Mistake #5

Knowing which assets to give away to your beneficiaries can save your estate and your beneficiaries big tax bills, even if you have a small net worth. If you plan on making a gift to charity from your estate, you can be even more tax savvy with your giving.

No, I’m Not Voting for Obama

Here are thirty reasons Obama doesn’t deserve a second term.

The Election Should Be Settled by a Single Question: Who Caused the Financial Crisis?

The presidential election should be settled by a single question: “Who caused the financial crisis of 2008?” President Obama’s entire campaign has centered on his claim that he inherited a mess caused by the failed policies of the past.

Video: From Poverty to Prosperity: A Pursuit of Personal Achievement

Though imperfect at best, the record of immigrants striving to reach our shores proves that are forefather’s defense of free enterprise created a fertile soil for human flourishing.

Chances Are Your Advisor Favors Romney

It might be a good idea to listen to those who watch the cause and effect in the economy on a regular basis.

Social Security: Henry VIII’s Family Benefits

Me: King Henry, let’s start off with this question: Are you now or have you ever been married?

Henry VIII: Yes (with a smirk).

Failing to Implement the Estate Plan–Mistake #6

One of the most common estate planning mistakes is a plan that is implemented incorrectly. Your estate plan is only worth the paper it is printed on unless you follow through on titling your assets correctly and updating your beneficiary designations.

Can ‘True Love’ Survive Student Loans and Lack of Employment?

Such a well-intentioned program which steals our youth, our love, our happiness, our faith and our self-esteem.

Youth Vote May Support More Economic Freedom

In 2008 Obama captured 66% of the youth vote. But unlike the liberal ideological baby boom generation, millennials are more pragmatic. Support for Obama among the 18- to 29-year-old age group has dropped to 48%.

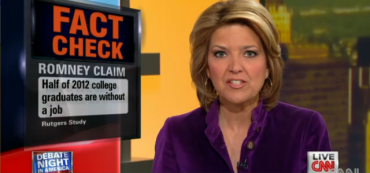

College Grads Need Jobs Not Sesame Street Subsidies

Are half of college graduates unable to get a college level job?

Retirement – Wealth Management Carnival #5

This week’s carnival deals with retirement plans and plans to retire. We hear some talk about retirement accounts, a blueprint for retiring early, and that baby boomers are going back to work.

Sesamenomics: Bert and Ernie Weigh In on Politics

A light hearted look at Bert and Ernie’s politics.