We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Financially Savvy Kittens on Free Fun Games

This kitten knows how to have fun for free. Be more like this kitten.

Government Taxes $33,356 Just Because a Couple Decides to Get Married

You cannot argue this increased tax is their “fair share” simply because they are married.

New Year’s Resolutions for the Country

To fulfill the financial resolutions of spending less, living within our means, and paying off our debt, the country first needs to encourage production rather than discourage it.

Investing for the New Year – Wealth Management Carnival #8

Wealth Management Carnival #8: This edition of the Wealth Management Carnival deals with investments, how-to tips, and some advice you may want to incorporate into your 2013 Resolutions.

Live Long and Prosper

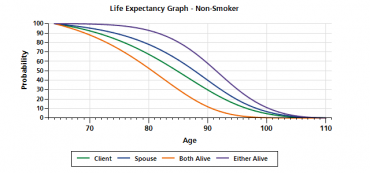

It’s not just Mister Spock who is living a long life. Japanese Jiroemon Kimura’s nearly 116 years, making him the oldest man in modern recorded history, is a reminder to have a retirement income plan that will last over the long haul.

Financially Savvy Kittens on Goal Setting and Keeping

This kitten boldly shares her goals with others. Be more like this kitten.

Carnival of Passive Investing – #25 – Gingerbread House Edition

Passive investing is like a ginger bread house, a sweet and beautiful harmonious selection of treats which work well together to build your financial house.

Trickle-Down Taxation

One of the strange and unintended consequences of targeting the rich with more taxes will be a greater gap between the rich and the poor as employees will shoulder their fair share no matter what.

Should I Invest IRA Funds in Real Estate? ($ ?s)

Q: I am looking for a way to get into the distressed real estate market. What recommendations do you have about investing IRA or 401(k) funds in rental houses?

Financially Savvy Kittens on Honoring the Budget

This kitten knows the difference between a want and a need. Be more like this kitten.

Merry Christmas 2012

Merry Christmas from the team at Marotta Wealth Management, Inc.

The Lord Mayor Would Have Spoiled “A Christmas Carol”

Studies suggest that both a gambling addiction and success in politics correlate with psychopathic behavior. Had Dickens included a gambler personality in a Christmas Carol, it would have been a different story.

Radio: Duo-Deci Taxation

David John Marotta was interviewed on radio 1070 WINA’s Schilling Show on December 11, 2012 discussing the Fiscal Cliff, rising taxation, and economic discrimination.

How To Market Time The Fiscal Cliff

How To Market Time The Fiscal Cliff? Don’t even try.

Is Your 401(k) Holding Too Much Company Stock?

Following the holiday season, many will feel the effects of overindulging on festive sweets. It turns out that your 401(k) also suffers when indulging on too much of a good thing.