In the investing world, the term “cost basis” usually means the original purchase price of an asset. However, there are some circumstances where the cost basis can be adjusted. One such case is the so-called step up to date of death, where property which is inherited from a decedent is allowed to use as the cost basis the fair market value of the property on the date of the decedent’s death.

In the investing world, the term “cost basis” usually means the original purchase price of an asset. However, there are some circumstances where the cost basis can be adjusted. One such case is the so-called step up to date of death, where property which is inherited from a decedent is allowed to use as the cost basis the fair market value of the property on the date of the decedent’s death.

Calculating the fair market value of property varies in difficulty depending on the type of property and the date of death.

For example, the fair market value for a publicly traded security is calculated as the average of the high price and the low price for trading that day. For mutual funds, which do not have a high or low price, it is the net asset value (NAV) for the trading day.

However, this begs the question: What do you do if the markets were not open on the date of death? There is no high price, low price, or net asset value on a weekend or market holiday. What happens if the decedent dies when the market is closed?

In this case, the fair market value is calculated using an average fair market value from the trading day prior and the trading day after the date of death. That is an average of the average, the average of the high and low prices on those two trading days divided by two.

An Example

Imagine the decedent died on Saturday, September 18, 2021, a weekend when the markets were closed, and we are trying to find the fair market value for Exxon Mobil stock (XOM) on that date.

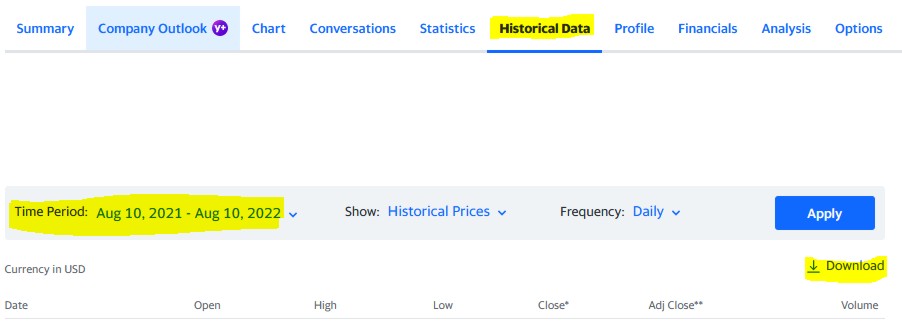

First, go to Yahoo Finance at https://finance.yahoo.com/ to gather the historical pricing information. Type the ticker symbol into the search bar and press enter to search. On the page that loads, select “Historical Data.”

Review the time period and adjust as necessary to ensure that it includes the date of death. Then, click the “Download” button. This will download a csv file of the price data. Open that csv file in Excel.

From there, locate the date prior to the date of death. For this example, we will use September 18, 2021, which was a Saturday and Exxon Mobil (XOM).

Here is the data showing the activity on the trading days prior to and following September 18, 2021:

Next, calculate the average of the highs and lows.

(56.75+55.1+54.17+52.96)/4 = 54.745

This can also be done in a simple three-part calculation:

- Calculate the high and low for the date prior to death.

- (56.75+55.1)/2 = 55.925

- Calculate the average of the high and low for the date immediately following death.

- (54.17+52.96)/2 = 53.565

- Average these 2 numbers and you have the new cost basis for the date of death.

- (55.925+53.565)/2 = 54.745

How to Update The Basis

Most custodians will perform this calculation for you, but you have to know that a step up in cost basis is available and you have to request that they step up the cost basis. Charles Schwab utilizes a “Step Up Cost Basis to Date of Death Request” form where you provide the date of death and the death certificate, then their cost basis team makes the calculation for you.

There are other times you will need to calculate the stepped up basis yourself. This can happen if your previous custodian did not perform the calculation, your current custodian won’t perform the calculation, or your stocks have not received a step up in basis.

Regardless of which case you are in, taking these few extra steps to ensure the basis is properly calculated can be quite valuable to ensure any capital gains tax you owe upon the sale of the asset reflects the stepped up basis.

Photo by Alexander Filonchik on Unsplash