We recently received the following reader question:

We recently received the following reader question:

I am attending the London Film School in Sept for my masters. The London Film School does not have housing for students. I am staying in a student housing apartment. Will my 529 pay for my student housing? Since there is no housing at the London Film School will the 529 pay for the entire amount of my student housing?

The first step to answering this question is to check that the school you want to attend is an eligible educational institution. The IRS defines an eligible educational institution as “a school offering higher education beyond high school. It is any college, university, trade school, or other post secondary educational institution eligible to participate in a student aid program run by the U.S. Department of Education.” The IRS helpfully says that to check if a school is eligible, you can simply “see if your school is on the U.S. Federal Student Aid Code List.” Later they say, “TIP: A small number of schools, not on this list, may be eligible educational institutions. So, you may need to ask the school.” The IRS links to the iLibrary Federal School Code List which is an Excel file you can browse through. Feel free to use this format, but there is a more user friendly way.

To determine if your institution is eligible, you can also simply search the FAFSA here to see if your university has a Federal School Code.

The search asks you for School Year, Federal School Code, State, City, and School Name. For a foreign country, select “Foreign Country” under State and type the School Name in the School Name field. In this case, I searched for “State: Foreign Country” and “School Name: London Film School.”

Indeed, the “London Interntl Film School” comes up with the Federal School Code of G10574, so this means that you can use 529 funds to pay for expenses at this foreign school.

The second step to answering this question is to find out if your school has a cost of attendance page. Open your favorite search engine and type “Cost of Attendance” in quotes followed by the name of your school. For this reader, that would be:

“Cost of Attendance” London Film School

In the case of this search, the first link is the one we want: US Federal Student Aid: Information for Applicants and Students from the London Film School.

Then, scroll down to the relevant school year. In this case, we are looking at the 2019-2020 school year.

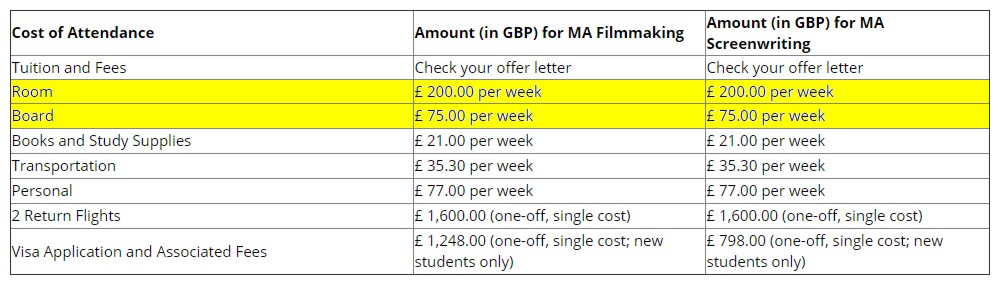

Then, review the table. You are looking for the expenses associated with “Room” and “Board.” This might also be called “Housing” and “Meals” or “Food.” If they make a distinction between “campus” versus “commuter,” you are looking for the campus numbers.

Some might split it out into multiple categories such as resident or non-resident and Undergraduate or Graduate. For this purpose, it should not matter which you pick. The Room and Board numbers should be the same for all such distinctions.

You may have to add the expenses for housing and meals together or they may already report them joined together.

Either way, the collective Room & Board cost of attendance estimate that you find is the limit for how much you can reimburse yourself for the cost of off-campus housing and meal expenses.

In the case of the London Film School, it looks like the total of “Room” and “Board” expenses for the 2019-2020 school year is placed at £ 275.00 per week. Here is a screenshot of what it looks like now in 2019 with the highlight added:

If you find that you spend more than that in off-campus housing and dining, then you will not be able to reimburse yourself for the entire amount of your expenses and will have to reimburse yourself only up to this estimate.

If however your expenses are less than this cap, then you should reimburse yourself for actual expenses.

Qualified distributions from 529 accounts can only be made either directly to the owner of the account, directly to the beneficiary of the account, or directly to the school. In this way, you cannot pay the grocery store or your landlord with 529 funds.

The proper way to charge these expenses is to pay for these charges directly from other funds and then reimburse yourself out of your 529 plan.

I was not able to find IRS law specific to 529 plans with regards to currency conversion, but with regards to U.S. tax returns, here is the IRS ruling:

Use the exchange rate prevailing when you receive, pay, or accrue the item. If there is more than one exchange rate, use the one that most properly reflects your income. You can generally get exchange rates from banks and U.S. Embassies.

Then, they link to the following resource: Treasury Department’s Currency Exchange Rate

In this way, I think the best practice is to download the “Get Historical Rates” PDF for the relevant month(s) from the Treasury Department. Save a copy with the relevant currency highlighted to put with your tax return documentation. And then use that number to make the exchange.

To read the PDF, find the relevant currency in the “Country-Currency” column. The easiest way to do this on the computer is to Search the document (Ctrl-F on Windows devices, Command-F on Mac) for the name of your currency. In this case, I searched for “pound” and found the record:

UNITED KINGDOM – POUND STERLING 0.7880

The number that is listed is “F.C. to $1.00” meaning Functional Currency (the one that is listed) in one U.S. dollar. This means that as of June 30, 2019 there are U.K. £0.7880 in one U.S. $1.00. This means that one pound is worth slightly more than one dollar.

To calculate an exchange into dollars, you would take the cost in pounds and divide by the F.C. to $1.00 number. So £100 would be 100 / 0.7880 or $126.90.

Let’s walk through this London Film School example. Pretend that you did a 3-month (12-week) program from May 2019 through July 2019 and incurred room and board expenses that are exactly average, meaning £ 275.00 per week. Imagine you look to reimburse yourself from your 529 plan the £3,300 you paid out in November 2019 as a part of your year-end accounting.

The treasury’s currency conversions come out quarterly in March, June, September, and December. By November, they will have already released the data as of September 30, 2019, but that won’t be the one you’ll want to use.

You’ll want to use the one that is the closest to when you incurred the charge. That would be the as of June 30, 2019 data.

The F.C. to $1.00 for June 2019 was 0.7880. Divide £3,300 by 0.7880 to get $4,187.82. This is then the amount that you would reimburse from your 529 for these expenses.

In this simple example, you only did the program for one quarter, so you only needed to use one currency exchange method. If you paid the bills monthly but stayed in the program for a full twelve months, then you would need to look up each quarter’s currency exchange separately. If you paid for the full twelves months at the start of the year, then you would only need to do one calculation using the month you paid for the full year.

Whatever calculations you do or information you look up, save it all with your tax return documentation. In the event that you have to defend yourself in response to an IRS letter, it will be easier if you have this information saved.

Photo by Marcus Loke on Unsplash