In Freedom Investing 2012 I analyzed the latest Index of Economic Freedom from The Heritage Foundation. Here I present some of the analysis for returns over the past 10-years.

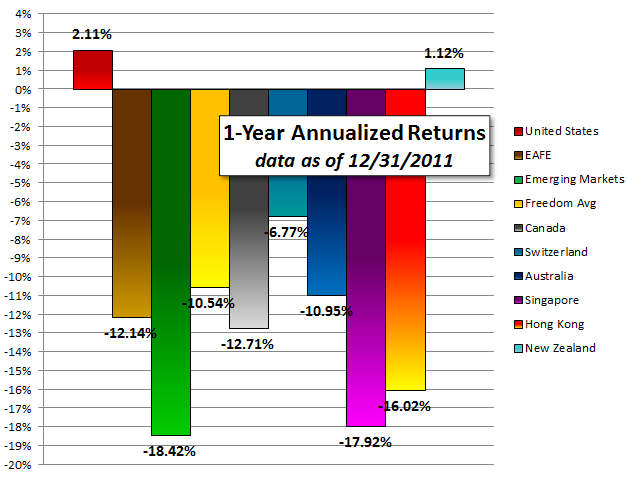

I took 13 of the developed countries with the largest investable markets and compared their current economic freedom score with their returns over the past 1, 3, 5 and 10 years. Only four of these countries are ranked in the free category: Hong Kong, Singapore, Australia and Switzerland. New Zealand is also among the most free countries in the world, but easily investable indexes were only added recently. Canada moved from free to mostly free this year. Two years ago the United States fell out as well.

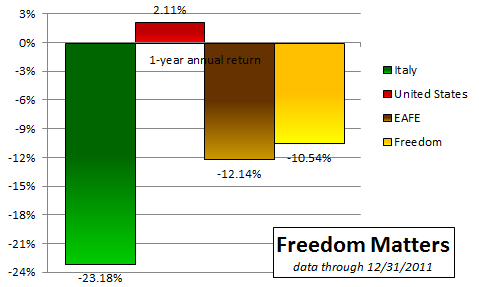

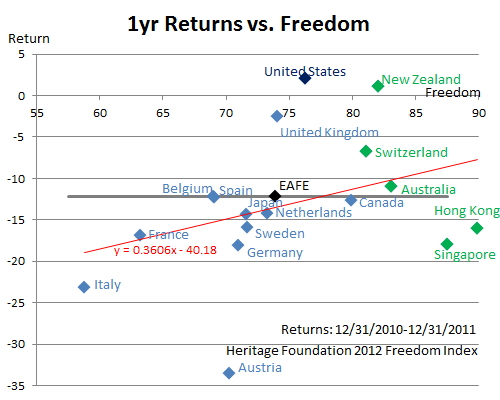

The nations in my analysis included 16 different developed countries representing 85% of the world’s investable markets and 98% of the developed countries. Freedom scores ranged from #1 in freedom Hong Kong at 89.9 to #92 ranked mostly unfree Italy at 58.8.

The ten year annualized returns were positive with the MSCI EAFE index up 4.67% and the United States up only 2.93%. Emerging markets was up 13.86%.

The five countries with the most economic freedom (Hong Kong, Singapore, Australia, Switzerland and Canada) however were up 10.23% beating the MSCI EAFE Index by 5.56% annually. Here is a chart showing each country’s 10 year returns:

Freedom investing boosted returns significantly over the past three years. Looking at the 10-year returns of all 16 of the developed countries in the analysis verses their current freedom index show the following correlation:

The equation of the trend line shows that every point on the freedom index was worth 0.33% annual return over the past year.

We believe this is one of the times when your asset allocation should tilt foreign and overweight the handful of countries with high economic freedom. Although many economists acknowledge that freedom matters, few investment strategies take advantage of this fact.

Disclosures: Our firm has been over weighting countries with the most economic freedom for several years. New subscribers to our blog receive free access to a 1.75 hour video presentation on “Where in the World to Invest?“

One Response

Dale

Dave, now that we know what the new tax rates are we should be able to continue to convert regular IRAs to Roths?