On my Charles Schwab Statement, what does “Total Capital Gains” mean under Income Summary? This number doesn’t match the Realized Capital Gains Report sent from my advisor. It is much lower.

– Trying to get started on my taxes

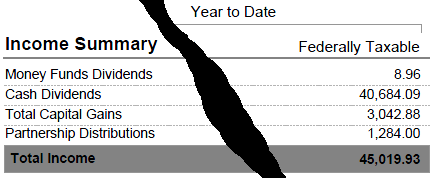

It is easy to get confused reading Charles Schwab‘s or any broker’s financial statement. The part of the statement you are referring to looks something like this:

Since the “Total Capital Gains” is under “Income Summary“, this is only the portion of Income payments (interest, dividends, distributions) which qualify as capital gains under the tax code. Currently interest is taxed at ordinary income tax rates, but capital gains is taxed at a lower rate.

This number ($3,042.88) does not include any capital gains as a result of selling stocks. That capital gains number is reported separately, often around January 31st along with your 1099 form. If you want to get a jump on your taxes, you can look up last year’s capital gains for your taxable accounts at Schwab online or you can use the figures from your financial advisor. Just be sure to double check the information after you receive your official report from Schwab.

Capital gains rules are changing for 2012 and again in 2013. There are great advantages to having a financial advisor who does tax planning with your CPA.