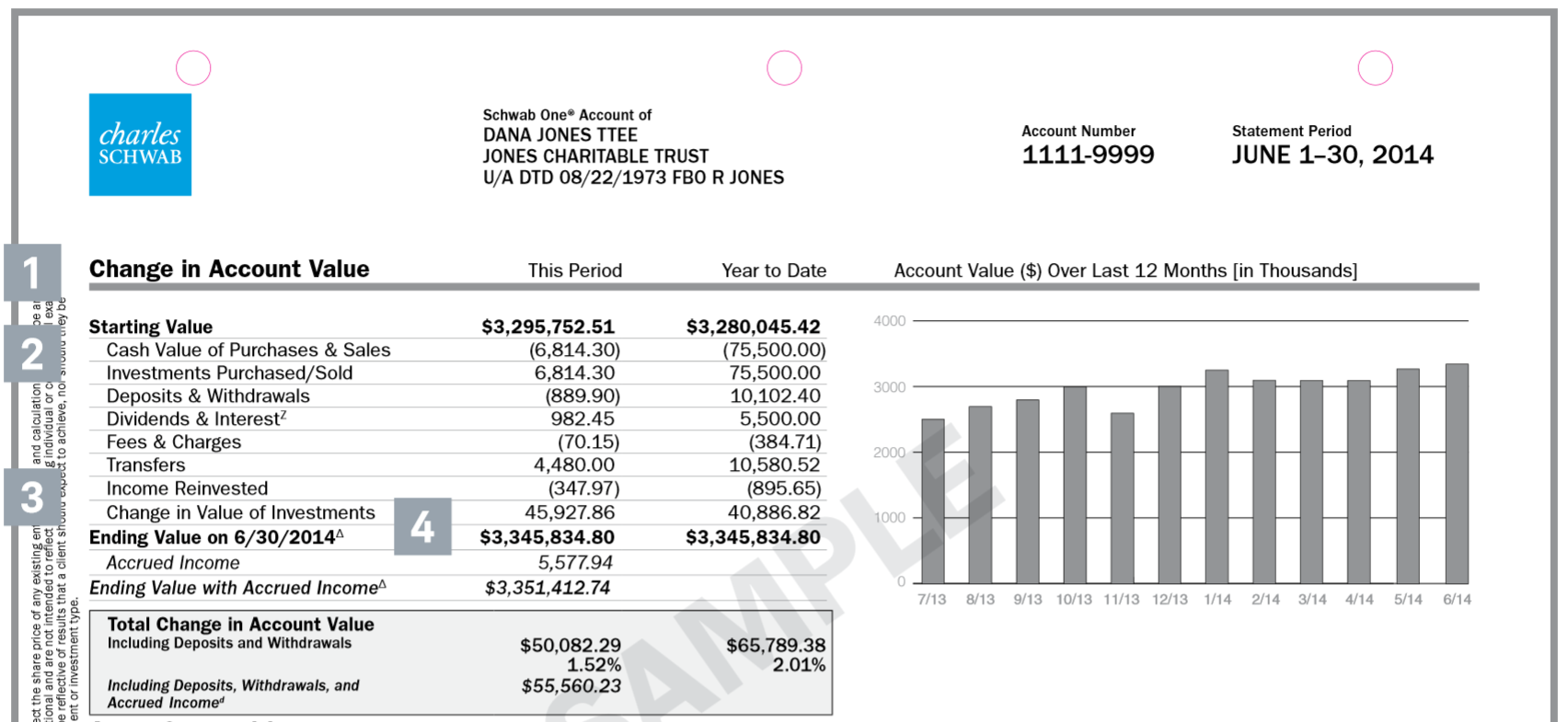

Here is the sample Schwab report:

What’s the difference between Schwab’s “Ending Value” line and their “Ending Value with Accrued Income” line on my monthly statements?

What number do you use in your reports?

This is Schwab’s footnote on the subject:

Accrued Income is the sum of the total accrued interest and/or accrued dividends on positions held in your brokerage account, but the income and/or dividends have not been received into your account and Schwab makes no representation that they will. Accrued amounts are not covered by SIPC account protection until actually received and held in the account.

There are four important dates when it comes to dividend payouts.

First, there is the date that a dividend is declared.

Second, there is what’s called the “ex-dividend date,” which is the date on which you need to own the stock to receive the declared dividend. If a dividend was declared but you bought the stock on or after the ex-dividend date, you won’t receive the dividend.

Third, the ex-dividend date is one day before the date of record, or the day the company consults their records, sees who their shareholders are, and thus who should receive the dividend.

Fourth and finally, there is the date of payment, which is when the dividend is actually paid. This is the date you finally receive the dividend you’re owed.

When a statement falls after the ex-dividend date and before the date of payment, your account value may be artificially low. Because new buyers won’t get the dividend, the price of the stock may have gone down. However, you have not gotten your dividend yet.

Because of this feeling that your account is only artificially low, some people like using “Ending Value with Accrued Income” in place of their real ending value.

However, there is a possible world where you won’t get some or all of the dividend that was declared, so the “Ending Value with Accrued Income” line is just a prediction.

That is why we report the “Ending Value” line on our reports. The dividend isn’t in your account yet, so we don’t report on it.

Photo by Benjamin on Unsplash