Q: Is it now time to short Treasuries? What do you think about using inverse ETFs to play the inevitable bear market for U.S. bonds?

Sincerely,

Shorting Uncle Sam

MONEY QUESTIONS answered by Matthew Illian, CFP®

Dear Shorting,

It is tempting to want to capitalize on the inevitable reversal in falling interest rates as inflation expectations increase. Seriously, how long can the 10-year Treasury notes hover around 2%? Although this opportunity may entice you, I recommend leaving the shorting of the fixed-income markets to the speculators.

The main problem with attempting to short the fixed-income markets is that you are fighting a steady trend. Fixed-income markets appreciate over time, and shorting an appreciating asset is a losing strategy. Even the thirty-year period that saw 10-year government bond rates climb from 2% in the early 1950s to 15% in the early 1980s experienced a 2% average annual return, as illustrated in my recent post. You lose money when you short an appreciating asset.

Over this time period, you would have been better off with a bond ladder or funds that continually reinvest bond distributions at new higher rates.

The second problem relates to the composition of these new inverse and leveraged exchange-traded fund (ETF) products that use derivatives. These ETFs are not backed by actual shares of stocks or bonds. Derivative-based ETFs are created by using counterparty derivatives (like swaps, futures, and repurchase agreements) that mimic the movement of an index. And just in case you missed all market commentary on the meltdown that began this Great Recession, financial derivatives are loaded with hidden risks and fees.

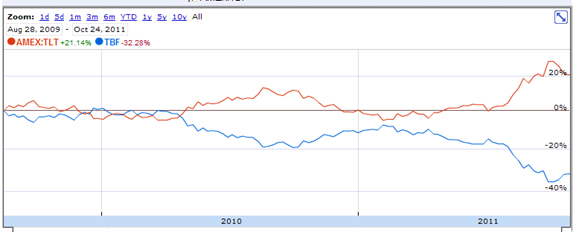

Derivative-based ETFs are not designed for the long-term investor. Over time, the costs of maintaining derivative contracts will chip away at returns. Compare the results of two ETFs that take opposite sides of the Barclays Capital 20+ Year U.S. Treasury Index. TLT is the iShares Barclays 20+ Year Treasury Bond EFT (long in red), and TBF is the ProShares Short 20+ Year Treasury ETF (in blue).

You will see that over time, the inverse fund (TBF) will lose more than the index gains. Since the first day of TBF trading, this derivative-based ETF has lost 11.14% more than what TLT gained. As time goes on, the breakeven points keep getting lower, which is why the prospectus highlights that these funds seek a target benchmark “for a single day.”

In the United States, the SEC has put on hold approving any more derivative-based ETFs until it studies this issue further. We do not invest in derivative-based ETFs because we aren’t interested in the “leveraged” or “short” market strategies that these ETFs typically offer (nor are we interested in the counterparty risk).

At Marotta Wealth Management, we have several simple rules that guide our investment philosophy. One important rule is only to invest in assets that grow over time. Shorting the fixed-income markets fails this test, and so we avoid the practice.

Short-term speculation is fun for those who enjoy playing the game but should never total more than 5% of your portfolio.

If you have a money question that is nagging at you, please submit it using our contact page. http://www.marottaonmoney.com/contact. We attempt to respond to every question. If yours is chosen for MONEY QUESTIONS, we will give you a pseudonym and let you know the date the Q&A will be published.