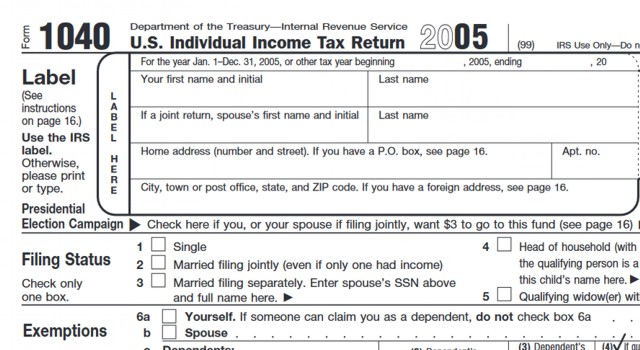

Unless it was your birthday, most of us are glad we have almost a year before we have to get our tax information together again. Before you store this past year’s return in the basement, take fifteen minutes, put your 1040 on the table beside this article, and gain some valuable wisdom on your finances.

Unless it was your birthday, most of us are glad we have almost a year before we have to get our tax information together again. Before you store this past year’s return in the basement, take fifteen minutes, put your 1040 on the table beside this article, and gain some valuable wisdom on your finances.

Make note of your Adjusted Gross Income (AGI) (1040 line 36) and your Total Federal Tax (1040 line 62).

Four additional numbers provide you with everything you need to determine your progress toward savings and retirement. You need to know how much you are putting into tax deferred savings each year, and how much you are putting into taxable savings each year. You also need to know the value of all your tax deferred accounts and of all your taxable accounts.

Your current Standard Of Living (SOL) is AGI minus Total Federal Tax minus your total state tax minus how much you are putting into taxable savings each year. Your SOL is a critically important financial planning number, because this is the standard of living that you will most probably be trying to maintain when you are retired.

Taxable savings counts more than tax sheltered savings. Before adding the two, first discount your tax deferred saving to 70% of its value. The resulting sum is your Total Retirement Savings (TRS). TRS divided by SOL must be a multiple of 20 to 25 before you can retire. Your multiple along with your age will tell you how long your assets will last into retirement.

If you are behind, increasing the amount you are putting into taxable savings helps you catch up in two different ways. First you are increasing the amount of your TRS each year, but more importantly, you are decreasing your SOL. Decreasing your SOL is the quickest path toward retirement.

There are a few fields on your tax return that you should check in order to make sure you are minimizing the tax impact of your finances.

Interest income (1040 line 8a) is taxed as ordinary income, while capital gains on stock are taxes at a rate of 15 percent or less. If your taxable interest is significant, consider moving some of your money from your bank account into dividend paying stocks.

Despite the way you might feel, receiving a refund (1040 line 71) is not a good thing. Receiving a refund is simply making the government an interest free loan for the year. If you did receive a refund, reduce the amount you are withholding and put the difference into taxable savings.

Check if you had to pay Alternative Minimum Tax (AMT) (1040 line 44). Since the AMT isn’t indexed for inflation, more middle income taxpayers have to pay the AMT each year. While only 19,000 people owed the AMT in 1970 when it was first established, 2 million will be paying it this year. Those subject to AMT pay an average of $6,000 more than they would otherwise. If you are one of those hit with AMT, conventional wisdom may not apply to some of your financial decisions and you should have your financial affairs reviewed professionally.

All of the effort that goes into tax preparation provides an opportunity for a trained eye to analyze your financial situation. Be smart and get a financial check up before forgetting about taxes for another year. Investing a little time to keep your financial affairs in order opens up a lot of opportunities to enjoy the life ahead.