As the price tag on graduate education continues to rise, it becomes increasingly important to determine if the additional diploma is worth the investment. With all of the planning data available for budding scholars, there’s no excuse not to crunch some numbers before making a huge financial decision. As my grandfather reminded me, “measure twice and cut once.”

The biggest factor in this decision is comparing your current earnings potential with your post-graduate school earnings potential. Some degrees offer a more lucrative pay bump than others but this also depends on your plans for using your degree.

How many years to breakeven?

There is no more personally rewarding investment than one in your own education. But sometimes this leads aspiring graduate students to pursue higher education without counting the cost. The first calculation is to determine how many years it will take you to recoup the costs of additional education. To begin, write down your current salary.

A. Current Salary: ____________________

If you haven’t yet joined the workforce, this could be measured as your current earnings potential. You can get an estimate of your salary using Payscale’s What am I worth? calculator. If you expect a big jump in your income after completing your advanced degree, it’s best to use after-tax salary estimates to recognize that you get to keep less of what you earn as your income goes up. Next, write down the salary you expect to earn after finishing your advanced education.

B. Projected Salary:_____________________

If you don’t know, you can also use the calculator above. Also consider checking to see if your school or program reports average salaries of their graduates in an employment report. For example, Georgetown University reports that MBA graduates finding employment in Not-for-Profit & Social Impact field receive an average salary of $81,513. It is better to be a bit conservative here, rather than too aggressive. Next, calculate the estimated costs of your education.

C. Cost of Education: ________ (Cost per year) X _________ (# of years) =___________

Even if don’t need to take out loans, you should still count the cost. I wouldn’t include room and board as a cost since food and a roof over your head are necessary wherever you are. But if you plan to significantly support the revenue of Starbucks during your study hours, this might be an includable food cost exception. You should also count the cost of books or any other materials or software purchased to support your education.

Lastly, you’ll need to calculate any lost earnings during your graduate school years.

D. Lost Income Due to Enrollment: ___________________

If you’re only attending school on nights and weekends, you might be able to avoid giving up your paycheck. Leave it to your psychiatrist to count the cost to your mental health of giving up nights and weekends; this exercise is a purely economic analysis.

Calculate: Number of Years to breakeven = (C + D) / (B – A)

For example, if a social worker discovers they have a strong aptitude for management they might consider going back to school for an MBA. A Georgetown University MBA will cost approximately $100,000 for the two-year program and then another $90,000 in lost wages (assuming social worker makes $45,000 per year). Added together, the total cost of gaining the qualifications to manage a social work and counseling organization is $190,000. This same social worker’s salary goes from $45,000 to $81,513 and I’m going to estimate that after taxes, he or she keeps 75% of this pay bump or about $27,000. Plugging in these costs and increased salary to the formula above leads to a breakeven of seven years.

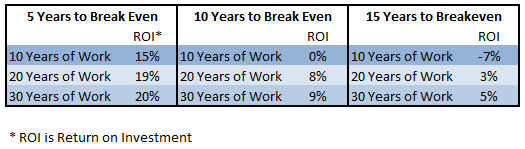

A good goal is to find a combination of education costs and salary increases where the breakeven occurs in less than ten years. Not only is this ten years a manageable mental hurdle, any longer and your return on investment becomes embarrassingly low. For example, if it takes fifteen years to break even, you will have only earned a 3% return after 20 years and 5% after 30 years of work at the higher salary. Compare this to someone who identifies a five year breakeven – their return on investment after 30 years of work is a very healthy 20%.

The reality for most is that your future path is sure to take many unexpected twists and turns. You can’t know for sure how many years you will be working at a given salary but you can make some conservative estimates that could help you avoid financial stress down the road. Run the numbers – your future self will thank you.

Photo used here under Flickr Creative Commons.