Would you be willing to give a contractor a blank check and no time limit to build your dream home? Beware of doing the same thing with your finances. Without a financial plan, your investments are controlling your dreams, not the other way around. You need a blueprint for your financial dreams to come true.

Would you be willing to give a contractor a blank check and no time limit to build your dream home? Beware of doing the same thing with your finances. Without a financial plan, your investments are controlling your dreams, not the other way around. You need a blueprint for your financial dreams to come true.

The blueprint in sound financial planning is called an Investment Policy Statement (IPS). A good one can put a stop to irrational investment decisions. Like a blueprint, an IPS not only provides a map of the project ahead, but it also provides a tool by which you can measure your success – or the success of your investment advisor. As your investment advisor implements your investment policy, you can determine if the construction accurately matches the blueprint.

Failure to Plan is Expensive

An IPS should tie all of your investment decisions to your goals and dreams. Although investment advisors are not required to create an Investment Policy Statement for their clients, drafting an IPS is certainly considered a best practice. Without one, you could easily find yourself with investments which do not help you reach your financial objectives.

The stories are many, like the one when one of our clients came to us because an advisor had invested his 85-year-old father’s money in 25-year bonds and a basket of high-tech stocks. The investments turned his father’s dream into a nightmare because of the advisor’s lack of a good blueprint.

The Core Attributes of an IPS

Your IPS should be both fixed and flexible: tough enough to anchor investment decisions during market fluctuations, yet elastic enough to allow you to take advantage of the dynamic nature of the market. A good Investment Policy Statement should do four things: tell your story, list your financial objectives, define your investment strategy, and establish an implementation plan. And, it should be clear enough for a third party to implement.

The IPS tells your story

Your IPS should begin by telling your story. It should include information such as your age, marital status, children, grandchildren, job status, and interests. It should also include a snapshot of your financial picture. For example, it should state your cash inflows and outflows and outline your current assets and liabilities.

The IPS lists your financial objectives

Next, your IPS should identify both your big-picture wants and your detailed needs. Do you have aspirations of opening a small-business? Will you be paying for your children’s college educations? Do you plan on retiring? If so, at what age? And, what lifestyle do you hope to enjoy in retirement? Do you have any special philanthropic goals? The IPS should capture your dreams and express them in terms of realizable objectives.

The IPS defines your investment strategy

Now, with an understanding of your financial position and a clear picture of what you want to accomplish financially, you can begin to define your investment strategy.

Each investment carries with it a certain level of risk, or volatility. In the investing world, bigger risks are rewarded with higher potential returns. How much risk are you willing to accept in order to meet your objectives? What is your time-horizon? What are your liquidity needs? What should be your mix between stocks and bonds? How should this change over time?

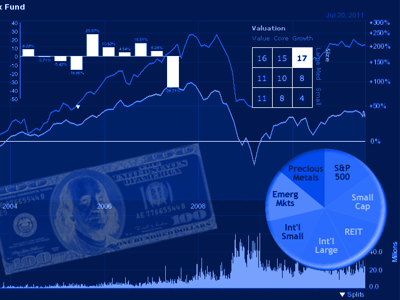

After establishing the parameters of time horizon and risk assumption, you are now ready to set your asset allocation. When it comes to predicting your investment returns, nothing influences returns more than your portfolio’s asset allocation mix. We invest our clients in six asset classes: US stocks, US bonds, foreign stocks, foreign bonds, hard assets, and cash.

The asset allocation portion of your IPS should outline investment vehicles and rebalancing procedures for your portfolio. For example, do you own investments which you do not wish to sell? Also, are there any investments vehicles or asset classes you do not wish to hold in your portfolio?

With your asset allocations now in place your IPS should define the rebalancing protocols to keep your portfolio in-line with your original allocations. For instance, will your account be rebalanced based on a particular timetable? And by what margin will the asset allocations be allowed to fluctuate before they are rebalanced?

The IPS determines how your account is monitored

Lastly, your IPS should outline the management procedure for your portfolio. Control procedures should list your investment advisor’s responsibilities, the criteria by which your advisor selects and monitors your investment vehicles, and the process for measuring and reporting performance.

Many investors don’t know the annual return on their investments, nor do they know how their returns compare to other benchmarks. A good IPS should include reporting requirements such as annual time-weighted returns on your investment. Without reporting protocols and benchmarking procedures, who can say if your advisor is making the grade or falling below average?

A well drafted, periodically updated Investment Policy Statement is critical to insure that your financial future will be safe and secure – that your financial dream home will actually be built.