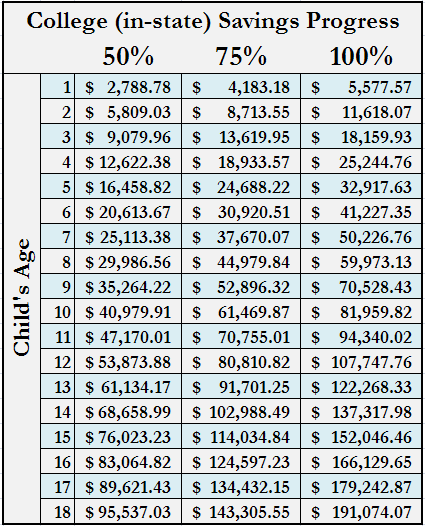

Each year, I share updated age-based benchmarks (see chart) we use to ensure that our 529 college savings plan is on track to meet our goals. I also use the opportunity to share some related college preparation insights with our readers.

Each year, I share updated age-based benchmarks (see chart) we use to ensure that our 529 college savings plan is on track to meet our goals. I also use the opportunity to share some related college preparation insights with our readers.

This year’s article was posted on Yahoo Finance (you can read the full text here) and I have to admit, I found the comments to this article rather frustrating. Don’t get me wrong, I’ve learned to develop a thick skin when sharing ideas with the masses but if these commenters represent some general barometer of financial sanity, we appear to be losing the battle.

Several of these respondents believe the myth that saving for college is a self-defeating prospect. The myth assumes that every dollar saved in a 529 plan is a dollar that is lost in financial aid. A related myth is that 529 savings is double counted both as an asset and then again as income when disbursed. The truth is not nearly so hostile to savers. 529 plans owned by parent’s are counted as an asset and 5.64% of this asset is added to the family’s expected family contribution (EFC). The formula is reasonable and fair. 529 plans owned by grandparents aren’t counted at all. Those who are within three years of college should use an EFC calculator to begin to estimate their expected contribution and plan accordingly.

Those who are truly unable to save for college will have plenty of support from Uncle Sam and generous college endowments that have been created to ensure that highly capable students have a financial lifeline. But those are are truly capable of contributing will be expected to pitch in.

Another strand of comments asserted, you can’t actually expect me to be able to do this, right?!!

For the record, I only expect people to save what they can. See, I’m a nice financial adviser. But I also believe that more people can save for college or retirement than actually do. In order to free up money for savings, we’ve made other choices. We drive old cars. We bike everywhere we can. We live in a moderately priced house. We often push financial gifts into our 529 savings accounts. We push money from our tax refunds into our 529 savings accounts.

We don’t need to live like misers to achieve these goals. We eat well. We travel often to visit friends and family. We go out on weekly dates and regularly invite friends over. We have found a saving/spending balance that treats our present and future selves fairly. Others will need to find their own balance.

It’s clear that my age-based benchmarks created a sense of shock in some. Staring at the tips of the peak is daunting for everyone. Start of by taking one step in the right direction. Complaining about how hard the entire journey will be is wearisome. Rather than focusing on the final goal, focus instead on saving $300 per month. How about $50? Go ahead, take a step.