I’ve been following the real estate market for a long time. Between 2005 and 2009 I annoyed local realtors by claiming that real estate values were headed lower . It is only when house prices are low and interest rates are low, that is the best time to buy a house. Here is a list of articles I have written over the past decade along with pertinent quotes:

1/24/2005 We Could be in a Real Estate Bubble

Real estate prices, especially residential, have been increasing for almost a decade. Real home prices have increased nearly 60% since 1996 – roughly triple that of previous housing booms in the late 1970s and 1980s. Home values may be peaking and ready to correct. …

A bubble is never known until after it has burst, and frequently a bubble continues to expand long after reason suggests it should have popped. As a result, it is impossible to predict with certainty if housing prices will drop and if so, by how much.

What can be suggested is that the housing prices boom shows signs of weakness, and that they may correct or at least under perform for the next few years. Higher interest rates will slow housing growth in 2005, but the bubble, if it is a bubble, could pop as late as 2006 or 2007.

4/9/2007 Breaking Spaghetti: A Seven-Year Financial History

Many homeowners with adjustable rate mortgages have seen their monthly payments increase 50%, due to the higher rates. With the sudden jump in monthly mortgage payments, many are finding they can no longer afford to stay in their homes. The rate of late payments and foreclosures has continued to rise leaving many lenders on the brink of bankruptcy themselves.

2/4/2008 For Now, Avoid Real Estate Investment Trusts

Investing in REITs during normal markets makes a lot of sense, but we suggest you continue to steer clear of them for the coming year. The beta of REITs versus the S&P 500 is currently about 1.68, which means REITs are about 1.68 times more volatile than the movements in the S&P 500.

Perhaps 90% of wealth management is avoiding the financial products and mistakes that surround us and compete for our attention. Real estate may seem attractive with today’s choppy U.S. markets, but we suggest you keep your money invested elsewhere until the Fed is done raising interest rates.

5/5/2008 Subprime Lending

Remember, this was written over 4 months before the financial meltdown.

But these old-fashioned criteria were historically what made loans secure and limited defaults. Forcing banks to lend money to those least likely to repay is not a sound policy.

That the credit debacle took two presidential terms to unravel is simply how economics works. Dropping interest rates and rising house prices masked the default rates as those who would have defaulted simply refinanced a larger loan, milking their homes for 100% of their value like an ATM machine.

Economist professors Stan Liebowitz and Ted Day criticized the program in 1998 in their article “Mortgages, Minorities, and Discrimination” in Economic Inquiry. They wrote, “After the warm and fuzzy glow of ‘flexible underwriting standards’ has worn off, we may discover that they are nothing more than standards that lead to bad loans. . . . These policies will have done a disservice to their putative beneficiaries if . . . they are dispossessed from their homes.” Unfortunately, no one ever listens to economists.

Everyone was busy praising lenders using relaxed underwriting standards as the paragon of virtue. Although widely understood that approving minority mortgage applications stretched the rules a bit, it was considered good social engineering. Now they are universally criticized by the same crowd that formerly praised them.

Today, the people who advocated lax lending standards are self-righteously critical of lenders for letting this debacle happen. Having forced millions of bad loans, they are now complaining the government is paying a small portion of the losses back to Bear Stearns. Having enacted regulations that ruined the U.S. financial markets, they now claim the credit problems stem from a lack of regulation. Only government uses its power to cause such havoc and then asserts it needs more power.

7/20/2009 Now’s the Time to Buy a House

Nathan Rothschild offered the contrarian advice to “Buy when there’s blood in the streets and sell to the sound of trumpets.” It is time to consider buying residential real estate. The bottom is forming, although it may continue to do so through early 2011. …

My parents’ mortgage when I was growing up was at 4.00%. I never thought rates would get anywhere near that low again. When my wife and I bought our first home, we were able to assume a 12.5% mortgage when rates for new loans were at 18%. Today you can get a 30-year fixed mortgage with no points for as low as 5.0%. Rates are at historical lows, so the next few years are the time to take advantage of them.

There’s blood in the street, so don’t miss this opportunity to look for a great real estate deal.

5/10/2010 Now’s Still the Time to Buy a House

And now in the spring of 2010, it is still the time to buy a house. …

It was only a few years ago that everyone was boasting about how real estate was appreciating by 1% every month. They made us feel like fools to be out of the market. With only a handful of listings out there, we were told that even if a glut of houses came on the market it would take years to satisfy the demand. But markets can turn quickly. Now we are contrarians again, looking at the trends and trying to gauge if there will be a second precipitous drop before the bottom. I don’t think so. I think that we are near the bottom and brighter days lie ahead.

In the meantime, there’s still blood in the street. Don’t miss this opportunity to look for a great real estate deal.

Now I think the time for getting a great deal buying a house is closing. Interest rates have rise as well as median house prices. I think you can still get some very attractive prices and loans, but not as good as nine months ago, and I think rates for both will only rise from here as well.

As you can see from the following charts, the time for buying is probably closing.

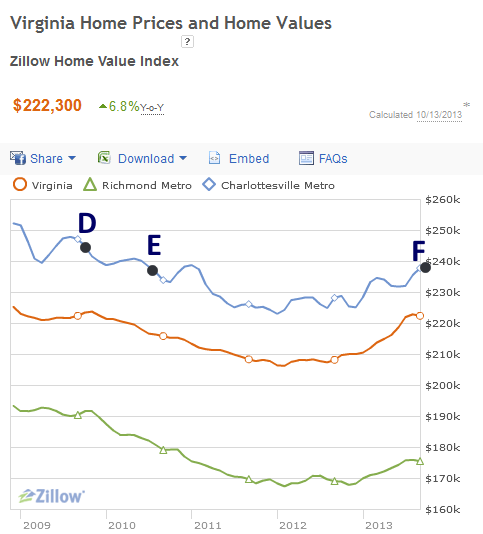

Here are the average home prices in Charlottesville, Richmond and Virginia. I have labeled the dates for the three dates I recommended it was not a good time to purchase:

- A. We Could be in a Real Estate Bubble (1/24/2005)

- B. Breaking Spaghetti: A Seven-Year Financial History (4/9/2007)

- C. For Now, Avoid Real Estate Investment Trusts (2/4/2008 )

- C. Subprime Lending (5/5/2008)

Along with the three dates I recommended it was a good time to purchase:

- D. Now’s the Time to Buy a House (7/20/2009)

- E. Now’s Still the Time to Buy a House (5/10/2010)

- F. Now (11/19/2013)

As you can see, it looks like home prices in Virginia have been good since my recommendation to buy and a house and that it was still time to buy a house. But home prices are recovering and I would expect we have seen the bottom of the housing market:

Virginia real estate into from Zillow.

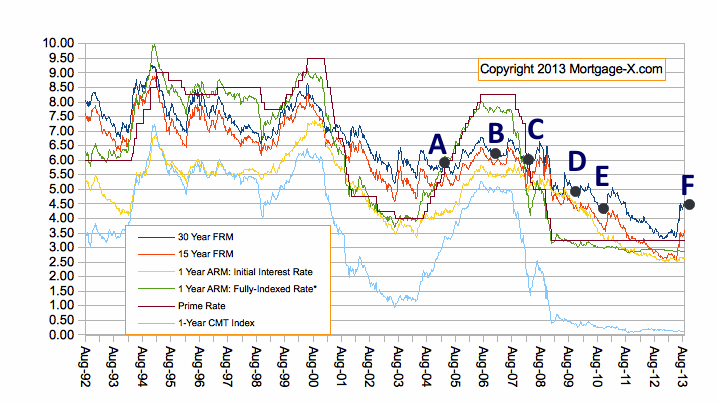

You can also see that interest rates have bottomed between E and F as well:

Reproduced with the permission of Mortgage-X.com

And specifically, between E and F mortgage rates have bottomed:

Chart from Bankrate.com.

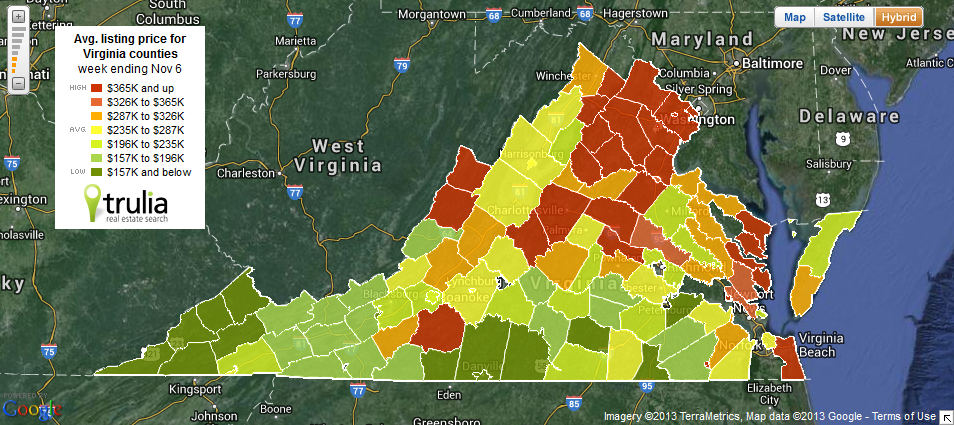

Here is the average listing price for Virginia counties:

Average listing prices by Trulia.com.

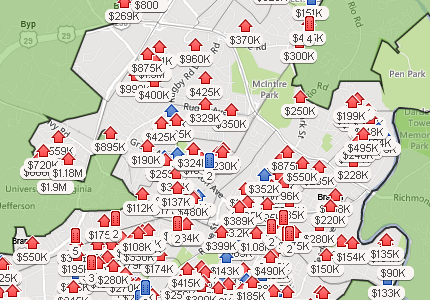

And here is the average listing price by zip code within Albemarle county:

Average listing prices by Trulia.com.

I expect we have seen the bottom of both the housing market and 30-year fixed interest rates. Last call on getting a great deal?