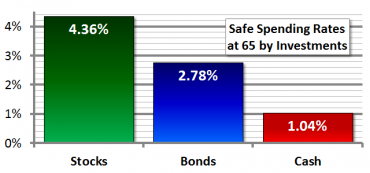

Investing Mostly in Bonds Means a Lower Lifestyle in Retirement

In the midst of this turmoil, especially after this past summer’s sharp drop, many investors wonder if they should put all of their investments into something safe and avoid the markets altogether.