Capital Gains Tax is an Economic Monkey Wrench (2012)

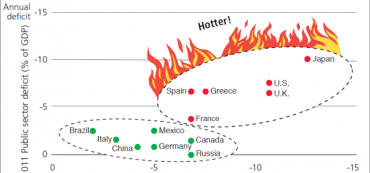

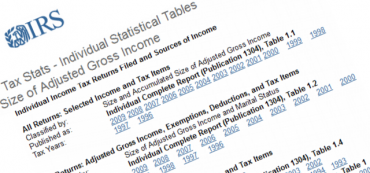

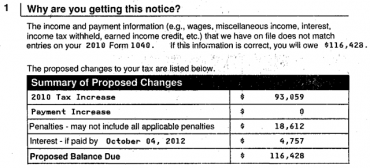

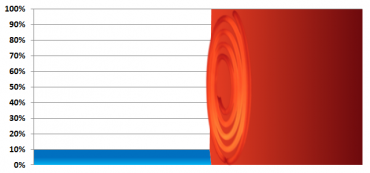

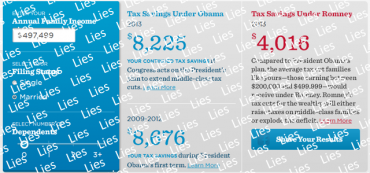

Tax on capital gains is scheduled to rise and become much more complex at the end of this year. Keeping your head in the midst of these changes can help your bottom line. Government should tax either the value of an asset or its yield but not both.