We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Four Reasons You Are Afraid of Investing

This kitten isn’t afraid of the markets. Be more like this kitten.

Are U.S. Stocks Overvalued?

“To answer that, it’s good to review key indicators, like the Shiller P/E ratio, and their recent history, experts say”

Government Officials Should Not Be Allowed to Plead the Fifth

Without public accountability, people are rightly suspicious that even the legitimate operations of government are corrupt.

Life Planning Edition – Wealth Management Carnival #13

Today’s Carnival covers a wide range of topics such as planning for your finances before college, what to do financially after college, how to think like the wealthy, and how to think about finances when one spouse doesn’t head to the office every day.

Should Gold Be Considered An Asset Class?

“The divergent claims about gold can be puzzling. How can a commodity that predominantly is either stored in a vault or gets formed into jewelry have so many stories spun around it?”

Making Peace with your Money Past

Money plays such a personal role in our lives that most people learn early on to keep their financial affairs a secret. These shadows promote many different varieties of financial pathologies and distress.

Do You Know What Your Appliances Cost You?

“Don’t air condition the outside” and “Turn the lights off when you leave a room” are often quoted as proverbs of energy savings, but the real savings is in several other appliances.

The Optimum Asset Allocation to Gold Is Always Zero

Fearful of monetary or societal failure, many hope that owning gold will bring them peace of mind.

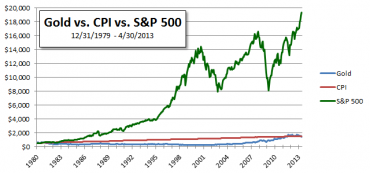

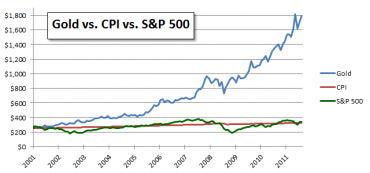

Since 1979 The S&P 500 Grew 13.5 Times Greater Than The Price Of Gold

Investing $512 in the S&P 500 at the end of 1979 grew with reinvested dividends for a total return of $19,323.19.

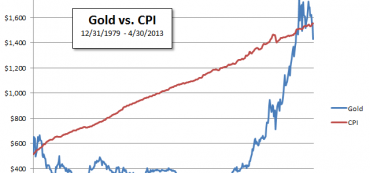

For The Past 34 Years, Gold Has Just Kept Up With Inflation

On average gold keeps up with inflation, albeit with wild gyrations.

Over 11 Years Gold Rose Over Six-Fold

From $255.95 gold rose to $1,795.00 between 4/2/2001 and 11/8/2011.

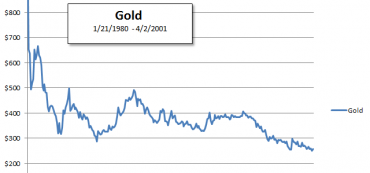

Over 21 Years Gold Lost 70% Of Its Value

From $850 gold dropped to $255.95 between 1/21/1980 and 4/2/2001.

Reply To Certified Gold Exchanges “Public Refutation”

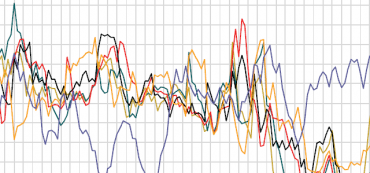

Gold advocates cherry pick gold’s returns from trough to peak.

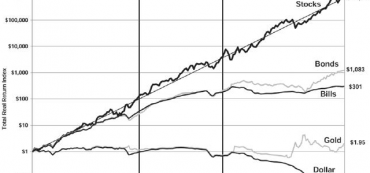

Stocks For The Long Run

Stocks have an average annualized appreciation over inflation of 6.86%, whereas gold is just 0.33% over inflation.

Inflation

Inflation is one of the most important factors in nearly every aspect of financial planning and wealth management.