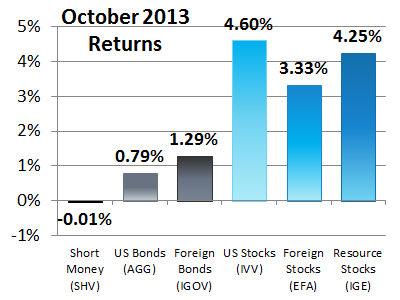

Returns were good in October. Unlike September, Foreign stocks had the smallest returns among equities.

Most investors make the mistake of measuring the performance of their portfolio against the performance of the S&P 500. This is an unreasonable expectation if the portfolio has any allocation to cash or bonds. Here, for example, is a typical asset allocation for a 40 year old, along with applying that portion of the portfolio to each of these six index funds:

| Asset Category | Allocation | Return | Appreciation | |||

| Short Money | 2.00% | -0.01% | 0.00% | |||

| US Bonds | 7.30% | 0.79% | 0.06% | |||

| Foreign Bonds | 5.30% | 1.29% | 0.07% | |||

| US Stocks | 31.70% | 4.60% | 1.46% | |||

| Foreign Stocks | 35.70% | 3.33% | 1.19% | |||

| Resource Stocks | 18.00% | 4.25% | 0.77% | |||

|

|

||||||

| TOTAL | 100.00% | 3.54% | ||||

Here you can see that although the iShares S&P 500 Index ETF (IVV) returned 4.60%, a benchmark return of 3.54% is a more reasonable expectation for a portfolio with a 14.6% allocation to Bonds and Short Money.

Even this six category methodology still simplifies the complex blending of several indexes in each of these six asset classes. For example, although EFA (foreign developed countries) returned 3.33% this quarter EEM (emerging markets) returned 4.88% pulling the return allocated to foreign stocks slightly higher. Meanwhile, in a departure from market behavior so far in 2013, small stocks laggest the rest of the U.S. equity market. iShares Russell 2000 Index ETF (IWM) returned only 2.51% during the month of September.